Linden plc started operations on January 1, 2017, and has used the FIFO method of inventory valuation

Question:

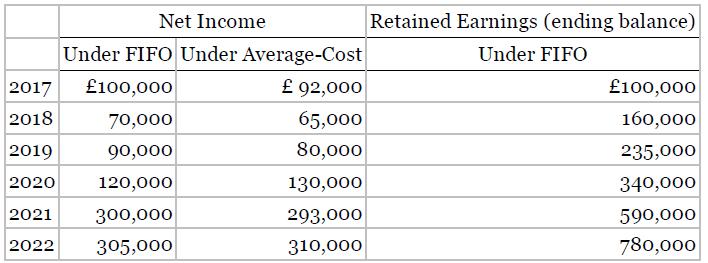

Linden plc started operations on January 1, 2017, and has used the FIFO method of inventory valuation since its inception. In 2022, it decides to switch to the average-cost method. You are provided with the following information.

Instructions

a. What is the beginning retained earnings balance at January 1, 2019, if Linden presents 2- year comparative financial statements starting in 2019?

b. What is the beginning retained earnings balance at January 1, 2022, if Linden presents 2- year comparative financial statements starting in 2022?

c. What is the beginning retained earnings balance at January 1, 2023, if Linden presents 2- year single-period financial statements for 2023?

d. What is the net income reported by Linden in the 2022 income statement if it presents 2- year comparative financial statements starting with 2020?

Step by Step Answer:

Intermediate Accounting IFRS

ISBN: 9781119607519

4th Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield