Unilever Group (GBR and NLD) is a leading international company in the nutrition, hygiene, and personal-care product

Question:

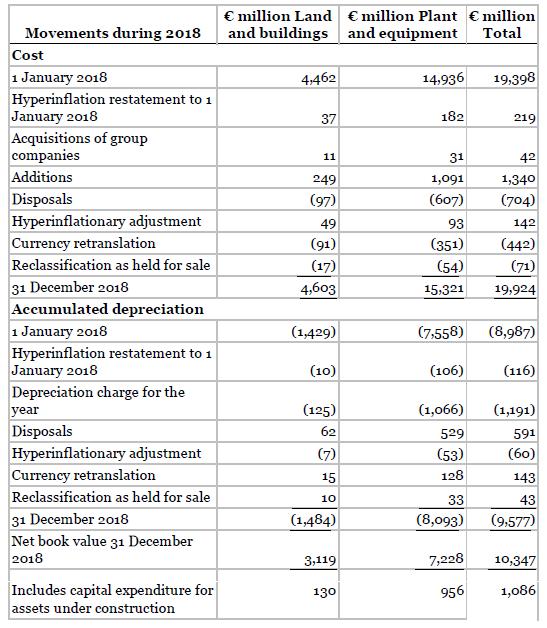

Unilever Group (GBR and NLD) is a leading international company in the nutrition, hygiene, and personal-care product lines. Information related to Unilever’s property, plant, and equipment in its 2018 annual report is shown in the notes to the financial statements as follows.

10. Property, Plant and Equipment

Property, plant and equipment is measured at cost including eligible borrowing costs less depreciation and accumulated impairment losses. Depreciation is provided on a straight-line basis over the expected average useful lives of the assets. Residual values are reviewed at least annually. Estimated useful lives by major class of assets are as follows:

Freehold buildings [no depreciation on freehold land] ....... 40 years

Leasehold land and buildings ................................................ 40 years [or life of lease if less]

Plant and equipment ................................................................. 2–20 years

Property, plant and equipment is subject to review for impairment if triggering events or circumstances indicate that this is necessary. If an indication of impairment exists, the asset or cash generating unit recoverable amount is estimated and any impairment loss is charged to the income statement as it arises.

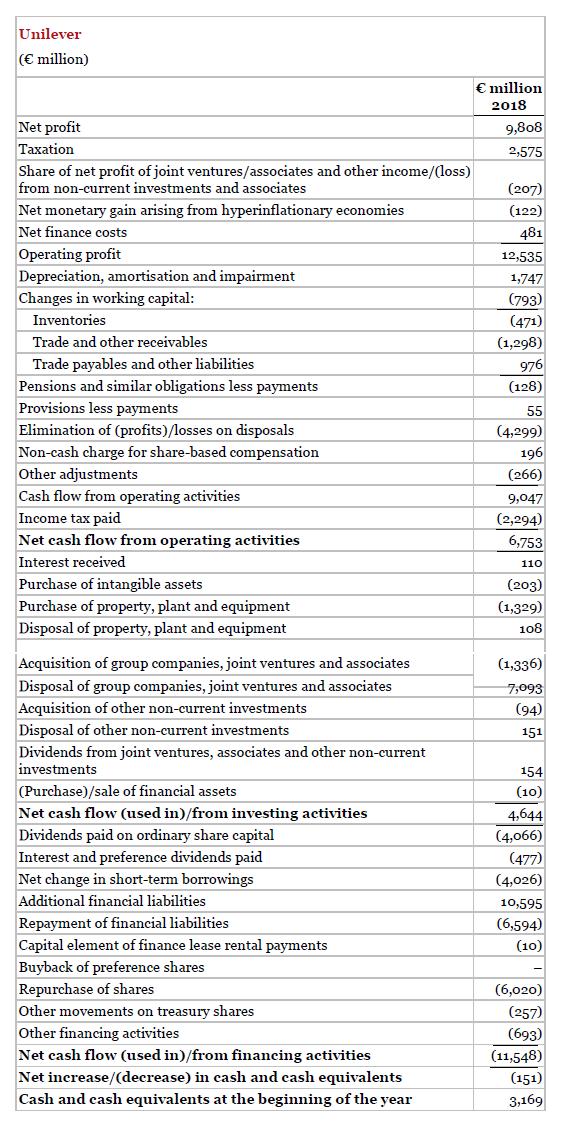

The Group has committed capital expenditure of €324 million (2017: €323 mllion). Unilever provided the following selected information in its 2018 cash flow statement.

Instructions

a. What was the carrying value of land, buildings, and equipment at the end of 2018?

b. Does Unilever use a conservative or liberal method to depreciate its property, plant, and equipment?

c. What were the actual interest expense and preference dividends paid by the company in 2018?

d. What is Unilever’s free cash flow? From the information provided, comment on Unilever’s financial flexibility.

Step by Step Answer:

Intermediate Accounting IFRS

ISBN: 9781119607519

4th Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield