Cullen Construction Company, which began operations in 2025, changed from the cost-recovery to the percentage-of-completion method of

Question:

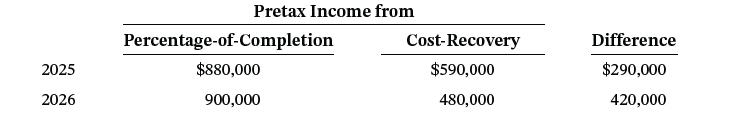

Cullen Construction Company, which began operations in 2025, changed from the cost-recovery to the percentage-of-completion method of accounting for long-term construction contracts during 2026. For tax purposes, the company employs the cost-recovery method and will continue this approach in the future. The appropriate information related to this change is as follows.

Instructions

a. Assuming that the tax rate is 20%, what is the amount of net income that would be reported in 2026?

b. What entry(entries) are necessary to adjust the accounting records for the change in accounting principle?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Intermediate Accounting

ISBN: 9781119790976

18th Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield

Question Posted: