Question: Cullen Construction Company, which began operations in 2020, changed from the completed-contract to the percentage-of-completion method of accounting for long-term construction contracts during 2021. For

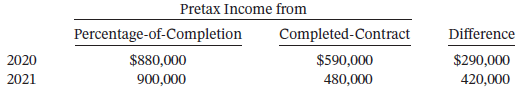

Cullen Construction Company, which began operations in 2020, changed from the completed-contract to the percentage-of-completion method of accounting for long-term construction contracts during 2021. For tax purposes, the company employs the completed-contract method and will continue this approach in the future. The appropriate information related to this change is as follows.

Instructions

a. Assuming that the tax rate is 20%, what is the amount of net income that would be reported in 2021?

b. What entry(ies) are necessary to adjust the accounting records for the change in accounting principle?

Pretax Income from Completed-Contract Percentage-of-Completion Difference $880,000 $590,000 480,000 $290,000 420,000 2020 2021 900,000

Step by Step Solution

3.43 Rating (166 Votes )

There are 3 Steps involved in it

a The net income to be reported in 2021 using the retrospective approach would be co... View full answer

Get step-by-step solutions from verified subject matter experts