Delta Oil Company uses the successful-efforts method to account for oil exploration costs. Delta started business in

Question:

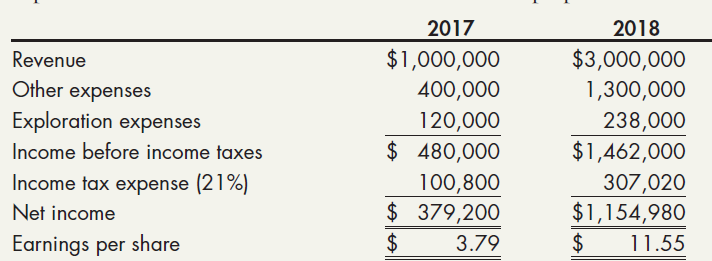

Delta Oil Company uses the successful-efforts method to account for oil exploration costs. Delta started business in 2017 and prepared the following income statements:

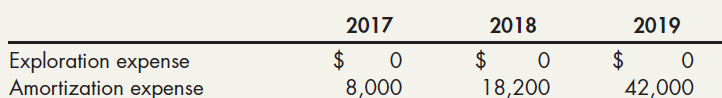

The company chooses to change to the full-cost method at the beginning of 2019. Under the full-cost method, Delta capitalizes all exploration costs of the Oil and Gas Properties asset account on its balance sheet. It determines the exploration and amortization expense amounts under the full-cost method to be as follows:

In addition, Delta reported revenue of $9,000,000 and other expenses of $4,200,000 in 2019. With the 2019 financial statements, the company issues comparative statements for the previous 2 years.

Required:

1. Prepare the journal entry to reflect the change.

2. Prepare the comparative income statements and the comparative statements of retained earnings for 2019, 2018, and 2017. Notes to the financial statements are not necessary.

3. Next Level Discuss the advantages and disadvantages of accounting for a change in this manner.

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Step by Step Answer:

Intermediate Accounting Reporting and Analysis

ISBN: 978-1337788281

3rd edition

Authors: James M. Wahlen, Jefferson P. Jones, Donald Pagach