Question: In 2019, Dreyer Corp. began construction work under a 3-year contract, which represents a single performance obligation. The contract price is $800,000, and the performance

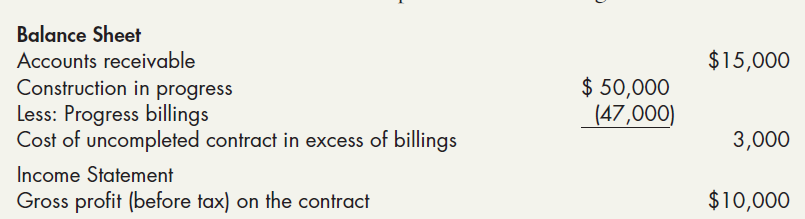

In 2019, Dreyer Corp. began construction work under a 3-year contract, which represents a single performance obligation. The contract price is $800,000, and the performance obligation is satisfied over time. The financial statement presentations relating to this contract on December 31, 2019, follow:

Required:

1. How much cash did Dreyer collect during 2019?

2. What percentage complete is Dreyer as of the end of 2019?

3. What is the estimated gross profit before tax on the contract as of the end of 2019?

Balance Sheet Accounts receivable Construction in progress Less: Progress billings Cost of uncompleted contract in excess of billings Income Statement Gross profit (before tax) on the contract $15,000 $ 50,000 (47,000) 3,000 $10,000

Step by Step Solution

3.40 Rating (162 Votes )

There are 3 Steps involved in it

1 The cash collected is the difference between the pr... View full answer

Get step-by-step solutions from verified subject matter experts