Question: Jay Company has had a defined benefit pension plan for several years. At the beginning of 2019, Jay amended the plan; this amendment provided for

Jay Company has had a defined benefit pension plan for several years. At the beginning of 2019, Jay amended the plan; this amendment provided for increased benefits to employees based on services rendered in prior periods. The prior service cost related to this amendment totaled $88,000. As a result, the projected benefit obligation increased. Jay decided not to fund the increased obligation at the time of the amendment, but rather to increase its periodic year-end contributions to the pension plan. The following information for 2019 has been provided by Jay’s actuary and funding agency and obtained from a review of its accounting records:

Projected benefit obligation (12/31) ............................................$808,090

Service cost .......................................................................................183,000

Discount rate ........................................................................................9%

Cumulative net loss (1/1) ..................................................................64,500

Company contribution to pension plan (12/31) ............................200,000

Projected benefit obligation (1/1)* .................................................513,000

Plan assets, fair value (12/31) ..........................................................698,000

Accrued pension cost (liability) (1/1) ................................................33,000*

Expected (and actual) return on plan assets ..................................48,000

Plan assets, fair value (1/1) ............................................................480,000

Retirement benefits paid ................................................................30,000

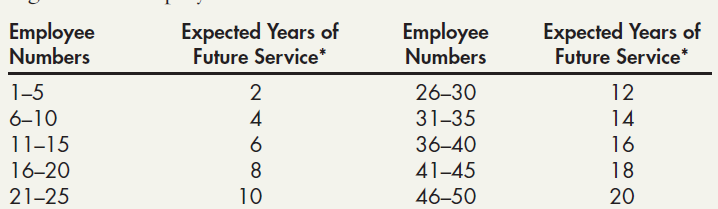

Jay decided to amortize the prior service cost and any excess cumulative net loss by the straight-line method over the average remaining service life of the participating employees. It has developed the following schedule concerning these 50 employees:

Required:

1. Compute the average remaining service life and prepare a schedule to determine the amortization of the prior service cost of Jay for 2019.

2. Prepare a schedule to compute the net gain or loss component of pension expense for 2019.

3. Prepare a schedule to compute the pension expense for 2019.

4. Prepare all the journal entries related to Jay’s pension plan for 2019.

5. What is Jay’s total accrued/prepaid pension cost at the end of 2019? Is it an asset or liability?

Expected Years of Future Service* Expected Years of Future Service* Employee Numbers Employee Numbers 1-5 2630 12 6-10 4 31-35 14 11-15 36-40 16 16-20 41-45 18 20 21-25 10 46-50

Step by Step Solution

3.27 Rating (162 Votes )

There are 3 Steps involved in it

1 2 3 Service cost Interest cost on projected benefit obligation 513000 88000009 183000 54090 Expect... View full answer

Get step-by-step solutions from verified subject matter experts