On January 1, 2019, Baznik Company adopted a defined benefit pension plan. At that time, Baznik awarded

Question:

On January 1, 2019, Baznik Company adopted a defined benefit pension plan. At that time, Baznik awarded retroactive benefits to certain employees. These retroactive benefits resulted in a prior service cost of $1,200,000 on that date (which it did not fund). Baznik has six participating employees who are expected to receive the retroactive benefits. Following is a schedule that identifies the participating employees and their expected years of future service as of January 1, 2019:

Employee ............................................Expected Years of Future Service

A ........................................................................................1

B ........................................................................................3

C ........................................................................................4

D ........................................................................................5

E ........................................................................................5

F ........................................................................................6

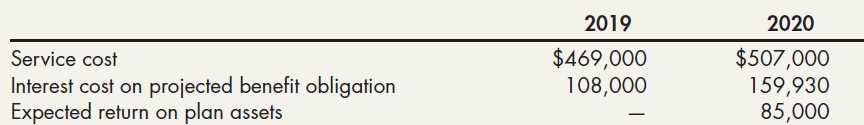

Baznik decided to amortize the prior service cost to pension expense using the years-of-future-service method. The following are the amounts of the components of Baznik’s pension expense, in addition to the amortization of the prior service cost for 2019 and 2020:

Baznik contributed $850,000 and $830,000 to the pension fund at the end of 2019 and 2020, respectively.

Required:

1. Next Level Prepare a set of schedules for Baznik to determine (a) the amortization fraction for each year and (b) the amortization of the prior service cost.

2. Next Level Prepare all the journal entries related to Baznik’s pension plan for 2019 and 2020.

Step by Step Answer:

Intermediate Accounting Reporting and Analysis

ISBN: 978-1337788281

3rd edition

Authors: James M. Wahlen, Jefferson P. Jones, Donald Pagach