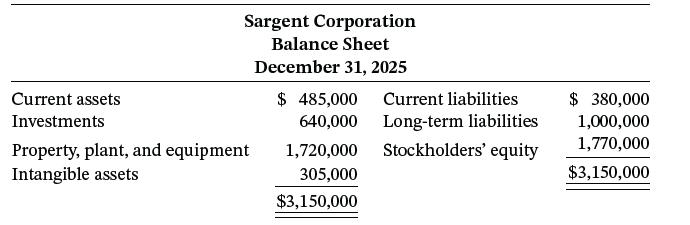

Presented below is the balance sheet of Sargent Corporation for the current year, 2025. The following information

Question:

Presented below is the balance sheet of Sargent Corporation for the current year, 2025.

The following information is presented.

1. The current assets section includes cash $150,000, accounts receivable $170,000 less $10,000 for allowance for doubtful accounts, inventories $180,000, and unearned rent revenue $5,000. Inventory is stated on the lower-of-FIFO-cost-or-net realizable value.

2. The investments section includes the cash surrender value of a life insurance contract $40,000; investments in common stock, short-term $80,000 and long-term $270,000; and bond sinking fund $250,000. The cost and fair value of investments in common stock are the same.

3. Property, plant, and equipment includes buildings $1,040,000 less accumulated depreciation $360,000, equipment $450,000 less accumulated depreciation $180,000, land $500,000, and land held for future use $270,000.

4. Intangible assets include a franchise $165,000, goodwill $100,000, and discount on bonds payable $40,000.

5. Current liabilities include accounts payable $140,000, notes payable—short-term $80,000 and longterm $120,000, and income taxes payable $40,000.

6. Long-term liabilities are composed solely of 7% bonds payable due 2033.

7. Stockholders’ equity has preferred stock, no par value, authorized 200,000 shares, issued 70,000 shares for $450,000; and common stock, $1 par value, authorized 400,000 shares, issued 100,000 shares at an average price of $10. In addition, the corporation has retained earnings of $320,000.

Instructions

Prepare a balance sheet in good form, adjusting the amounts in each balance sheet classification as affected by the information given above.

Step by Step Answer:

Intermediate Accounting

ISBN: 9781119790976

18th Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield