Question: Refer to the data for Novations, Inc., in Problem 5-35. Instructions: 1. Prepare an income statement for Novations, Inc. , for the year ended December

Refer to the data for Novations, Inc., in Problem 5-35.

Instructions:

1. Prepare an income statement for Novations, Inc. , for the year ended December 31 , 2002.

2. Prepare a statement of cash flows for the year ended December 3 1 , 2002, using the indirect method.

Problem 5-35:

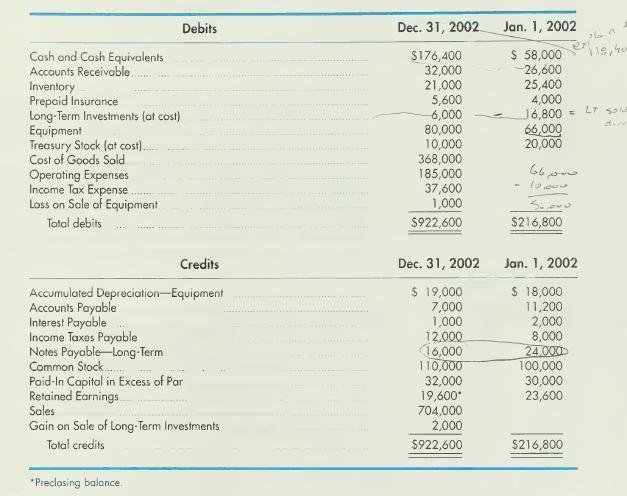

The table on the next page shows the account balances of Novations, Inc., at the beginning and end of the company's accounting period.

The following additional information is available.

(a) All purchases and sales were on account.

(b) Equipment costing \($10,000\) was sold for \($3,000;\) a loss of \($1,000\) was recognized on the sale.

(c) Among other items, the operating expenses included depreciation expense of \($7,000;\) interest expense of \($2,800;\) and insurance expense of \($2,400\).

(d) Equipment was purchased during the year by issuing common stock and by paying the balance (\($12,000)\) in cash.

(e) Treasury stock was sold for \($4,000\) less than it cost; the decrease in owners' equity was recorded by reducing retained earnings. No dividends were paid during the year.

Instructions:

1. Prepare a statement of cash flows for the year ended December 3 1 , 2002 , using the direct method of reporting cash flows from operating activities.

2. Comment on the lack of dividend payment. Does a "no dividend " policy seem appropriate under the current circumstances for Novations, Inc.?

3. Compute cash flow ratios for Novations, Inc. Comment on your analysis of the cash flow ratios.

Debits Dec. 31, 2002. Cash and Cash Equivalents Accounts Receivable.. Inventory 21,000 Prepaid Insurance 5,600 $176,400 32,000 $ 58,000 -26,600 25,400 expla 119, 40 Jan. 1, 2002 4,000 Long-Term Investments (at cost) 6,000 6,800 = LT sala dire Equipment 80,000 66,000 Treasury Stock (at cost).... 10,000 20,000 Cost of Goods Sold 368,000 Operating Expenses Income Tax Expense. Loss on Sale of Equipment. Total debits 185,000 660 616 37,600 10.000 1,000 $922,600 S.. $216,800 Credits Dec. 31, 2002 Jan. 1, 2002 Accumulated Depreciation-Equipment Accounts Payable Interest Payable Income Taxes Payable Notes Payable-Long-Term Common Stock......... $ 19,000 1,000 11,200 2,000 12,000 8,000 16,000 24.000 110,000 100,000 Paid-In Capital in Excess of Par 32,000 30,000 Retained Earnings... 19,600* 23,600 Sales 704,000 Gain on Sale of Long-Term Investments 2,000 Total credits $922,600 $216,800 7,000 $ 18,000 *Preclosing balance.

Step by Step Solution

3.35 Rating (164 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts