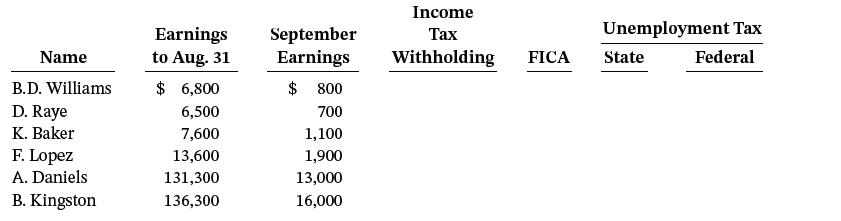

The following is a payroll sheet for Otis Imports for the month of September 2025. The company

Question:

The following is a payroll sheet for Otis Imports for the month of September 2025. The company is allowed a 1% unemployment compensation rate by the state; the federal unemployment tax rate is 0.8% and the maximum for both is $7,000. Assume a 10% federal income tax rate for all employees and a 7.65% FICA tax on employee and employer on a maximum of $142,800. In addition, 1.45% is charged both employer and employee for an employee’s wages in excess of $142,800 per employee.

Instructions

a. Complete the payroll sheet and make the necessary entry to record the payment of the payroll.

b. Make the entry to record the payroll tax expenses of Otis Imports.

c. Make the entry to record the payment of the payroll liabilities created. Assume that the company pays all payroll liabilities at the end of each month.

Step by Step Answer:

Intermediate Accounting

ISBN: 9781119790976

18th Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield