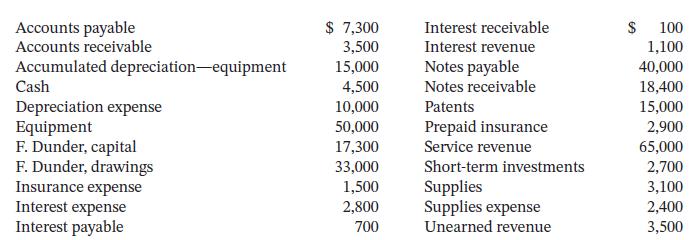

Below is an alphabetical list of the adjusted accounts of Dunder Tour Company at its year end,

Question:

Below is an alphabetical list of the adjusted accounts of Dunder Tour Company at its year end, December 31, 2024. All accounts have normal balances.

Additional information:

1. In 2025, $3,000 of the notes payable becomes due.

2. The note receivable is due in 2026.

3. On July 18, 2024, Fred Dunder, the owner, invested $3,200 cash in the business.

Instructions

a. Calculate the post-closing balance in F. Dunder, Capital on December 31, 2024.

b. Prepare a classified balance sheet.

c. On December 31, 2023, Dunder Tour Company had current assets of $17,400 and current liabilities of $22,300. Calculate the company’s working capital and current ratio on December 31, 2023, and December 31, 2024.

d. On December 31, 2023, the total of Dunder Tour Company’s cash, short-term investments, and current receivables was $15,600. Calculate the company’s acid-test ratio on December 31, 2023, and December 31, 2024.

Taking It Further

Has the company’s short-term ability to pay its debts improved or weakened over the year?

Step by Step Answer:

Accounting Principles Volume 1

ISBN: 9781119786818

9th Canadian Edition

Authors: Jerry J. Weygandt, Donald E. Kieso, Paul D. Kimmel, Barbara Trenholm, Valerie Warren, Lori Novak