Ilana Mathers, CPA, was hired by Interactive Computer Installations to prepare its financial statements for March 2024.

Question:

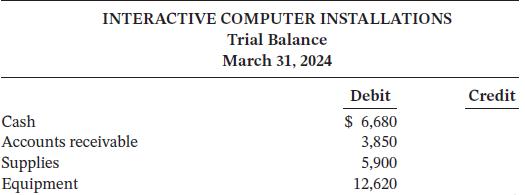

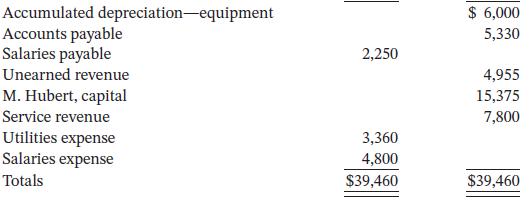

Ilana Mathers, CPA, was hired by Interactive Computer Installations to prepare its financial statements for March 2024. Using all the ledger balances in the owner’s records, Ilana put together the following trial balance:

Ilana then reviewed the records and found the following items:

1. The purchase on account of equipment for $5,100 on March 1 was recorded as a debit to Supplies and a credit to Accounts Payable, both for $5,200.

2. March rent of $2,050 was paid on March 2. The company recorded this as a debit to Utilities Expense and a credit to Cash, both for $2,050.

3. Cash of $1,735 was received from a customer on account. It was recorded as a debit to Cash and a credit to Service Revenue, both for $1,735.

4. A payment of a $575 account payable was entered as a debit to Cash and a credit to Accounts Receivable, both for $575.

5. The first salary payment made in March was for $3,000, which included $750 of salaries payable on February 28. The payment was recorded as a debit to Salaries Payable of $3,000 and a credit to Cash of $3,000. (No reversing entries were made on March 1.)

6. The owner, Maurice Hubert, paid himself $1,800 and recorded this as salaries expense.

7. The depreciation expense for the month of March has not been recorded. All of the company’s equipment is expected to have a five-year useful life.

Instructions

a. Prepare an analysis of any errors and show (1) the incorrect entry, (2) the correct entry, and (3) the correcting entry.

b. Prepare a correct trial balance.

Taking It Further

Explain how the company’s financial statements would be incorrect if error 6 was not corrected and why it is important to correct this error.

Step by Step Answer:

Accounting Principles Volume 1

ISBN: 9781119786818

9th Canadian Edition

Authors: Jerry J. Weygandt, Donald E. Kieso, Paul D. Kimmel, Barbara Trenholm, Valerie Warren, Lori Novak