Comfy Feet manufactures slippers. In 2020, the company hired a new bookkeeper who did not have appropriate

Question:

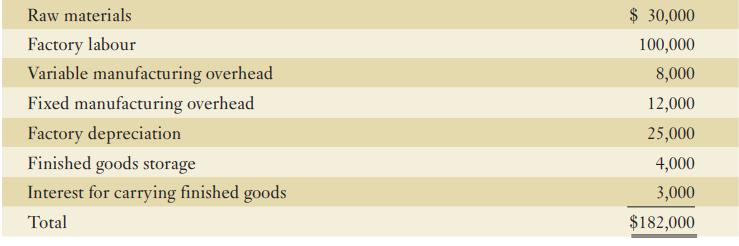

Comfy Feet manufactures slippers. In 2020, the company hired a new bookkeeper who did not have appropriate training. The bookkeeper charged to “production expense” all of the following costs for manufacturing 70,000 pairs of slippers:

The company had zero work in process at the end of both 2019 and 2020. Finished goods amounted to 5,000 pairs of slippers at $2.40/pair at the end of 2019. There were 6,000 pairs of slippers in finished goods inventory at the end of 2020.

Required:

a. Provide the adjusting journal entry or entries to correct the bookkeeper’s errors and properly record the above expenditures recorded in the “production expense” account.

b. Assume the company uses a periodic inventory system and the FIFO cost flow assumption for finished goods. Compute the cost of goods sold and the ending value of finished goods inventory for 2020.

c. Now assume the company uses the weighted-average cost flow assumption. Compute the cost of goods sold and the ending value of finished goods.

Step by Step Answer: