Question: 1. Which index weighting approach does not approximate the performance of a buy-and-hold portfolio strategy? Explain. 2. How much would an investor have to

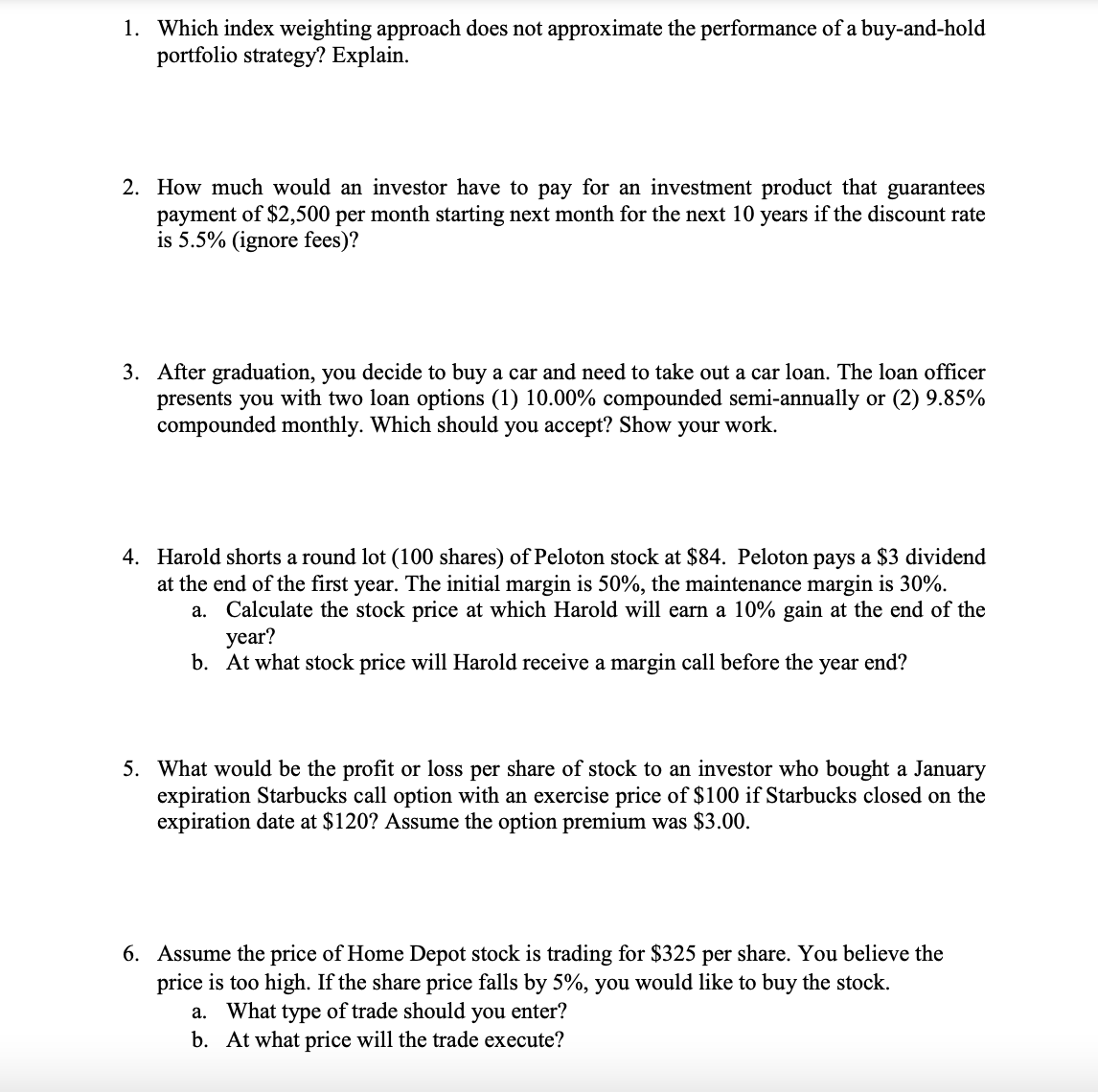

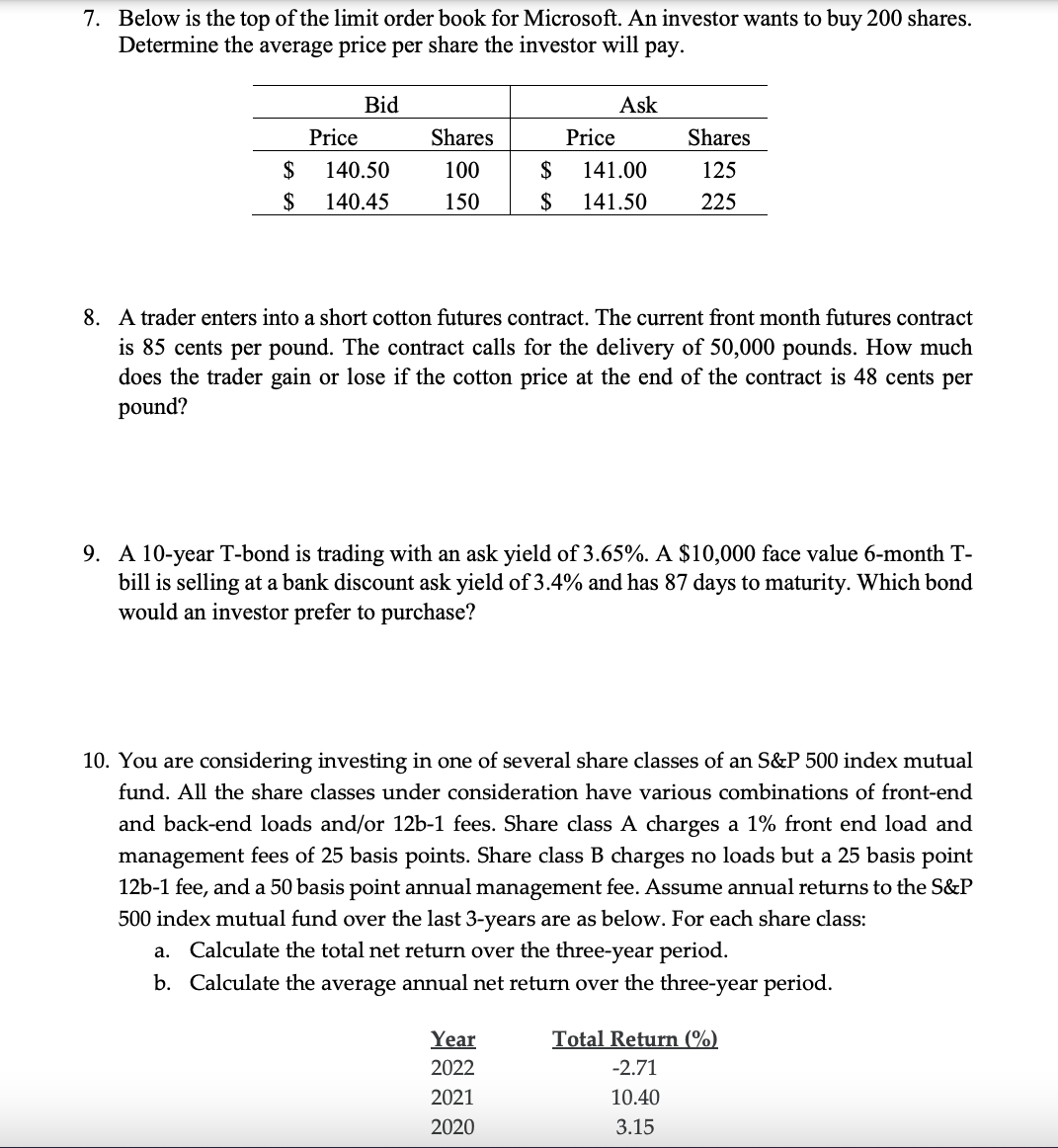

1. Which index weighting approach does not approximate the performance of a buy-and-hold portfolio strategy? Explain. 2. How much would an investor have to pay for an investment product that guarantees payment of $2,500 per month starting next month for the next 10 years if the discount rate is 5.5% (ignore fees)? 3. After graduation, you decide to buy a car and need to take out a car loan. The loan officer presents you with two loan options (1) 10.00% compounded semi-annually or (2) 9.85% compounded monthly. Which should you accept? Show your work. 4. Harold shorts a round lot (100 shares) of Peloton stock at $84. Peloton pays a $3 dividend at the end of the first year. The initial margin is 50%, the maintenance margin is 30%. a. Calculate the stock price at which Harold will earn a 10% gain at the end of the year? b. At what stock price will Harold receive a margin call before the year end? 5. What would be the profit or loss per share of stock to an investor who bought a January expiration Starbucks call option with an exercise price of $100 if Starbucks closed on the expiration date at $120? Assume the option premium was $3.00. 6. Assume the price of Home Depot stock is trading for $325 per share. You believe the price is too high. If the share price falls by 5%, you would like to buy the stock. a. What type of trade should you enter? b. At what price will the trade execute? 7. Below is the top of the limit order book for Microsoft. An investor wants to buy 200 shares. Determine the average price per share the investor will pay. Bid Ask Price Shares Price Shares $ 140.50 100 $ 141.00 125 $ 140.45 150 $ 141.50 225 8. A trader enters into a short cotton futures contract. The current front month futures contract is 85 cents per pound. The contract calls for the delivery of 50,000 pounds. How much does the trader gain or lose if the cotton price at the end of the contract is 48 cents per pound? 9. A 10-year T-bond is trading with an ask yield of 3.65%. A $10,000 face value 6-month T- bill is selling at a bank discount ask yield of 3.4% and has 87 days to maturity. Which bond would an investor prefer to purchase? 10. You are considering investing in one of several share classes of an S&P 500 index mutual fund. All the share classes under consideration have various combinations of front-end and back-end loads and/or 12b-1 fees. Share class A charges a 1% front end load and management fees of 25 basis points. Share class B charges no loads but a 25 basis point 12b-1 fee, and a 50 basis point annual management fee. Assume annual returns to the S&P 500 index mutual fund over the last 3-years are as below. For each share class: a. Calculate the total net return over the three-year period. b. Calculate the average annual net return over the three-year period. Year 2022 Total Return (%) -2.71 2021 10.40 2020 3.15

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts