QAF Company is a clothing retailer with locations in major Canadian cities. Its shares are publicly traded.

Question:

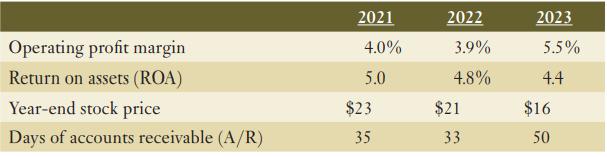

QAF Company is a clothing retailer with locations in major Canadian cities. Its shares are publicly traded. In 2021 and 2022, the company’s financial performance was less than stellar, as shown in the table below:

Operating profit margin is the ratio of after-tax operating profit divided by sales. ROA is equal to after-tax operating profit divided by average total assets. Days of A/R is the balance of A/R at year-end divided by credit sales and multiplied by 365 days. In response to declining performance, the company’s board of directors decided to initiate an incentive compensation plan starting in fiscal year 2023. The incentive plan provides for management bonuses based on the following formula:

![]()

Required:

Provide plausible reasons why the company is performing poorly despite the new incentive compensation plan.

Step by Step Answer: