Question: Alpha Ltd. is considering building a second plant at a cost of $4,700,000. Management has two alternatives to obtain the funds: (1) sell additional common

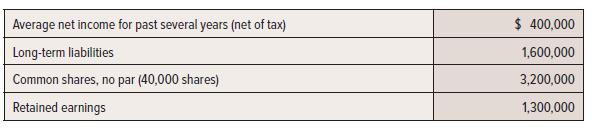

Alpha Ltd. is considering building a second plant at a cost of $4,700,000. Management has two alternatives to obtain the funds: (1) sell additional common shares or (2) issue $4,700,000, five-year bonds payable at 9% interest. Management believes that the bonds can be sold at par for $4,700,000 and the shares at $65 per share. The statements (before the new financing) show the following selected information:

The average income tax rate is 25%. Dividends per share have been $5 per share per year. Expected increase in pre-tax income (excluding interest expense) from the new plant is $950,000 per year.

Required:

1. Prepare an analysis to show, for each financing alternative:

a. Expected total net income after the addition;

b. After-tax cash flows from the company to prospective owners of the new capital; and

c. The (leverage) advantage or disadvantage to the present shareholders of issuing the bonds to obtain the financing, as represented by comparing return-on-assets to return-on-equity.

2. What are the principal arguments for and against issuing the bonds, as opposed to selling the common shares?

Average net income for past several years (net of tax) Long-term liabilities Common shares, no par (40,000 shares) Retained earnings $ 400,000 1,600,000 3,200,000 1,300,000

Step by Step Solution

3.36 Rating (159 Votes )

There are 3 Steps involved in it

Requirement 1 There is no financial leverage if shares are used to finance the acquisition Financial ... View full answer

Get step-by-step solutions from verified subject matter experts