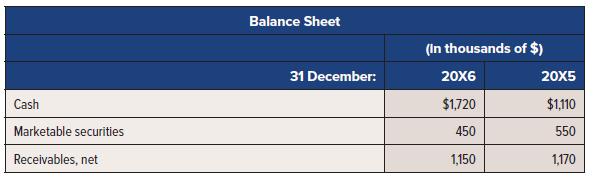

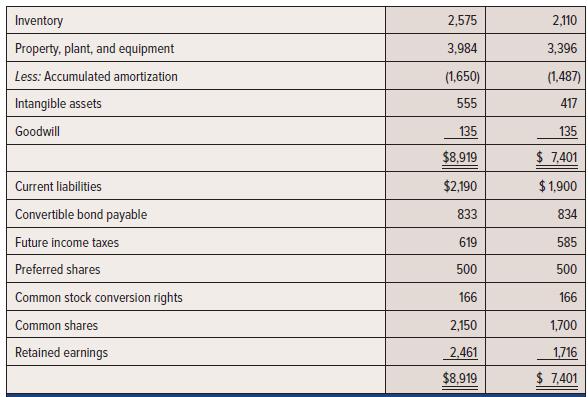

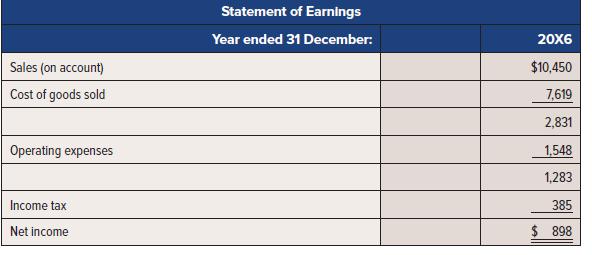

The following information is available for Davison Ltd., a private company, for the year ended 31 December

Question:

The following information is available for Davison Ltd., a private company, for the year ended 31 December 20X6:

Additional information:

• The company has a $1,000,000, 10% bond outstanding. Each $1,000 bond is convertible into 50 common shares at the investor’s option. The bond proceeds were split between the

debt and equity when the bond was issued. In 20X6, interest expense of $98 per bond was recognized.

• The tax rate is 30%.

• In 20X6, stock options were outstanding to key employees, allowing them to buy 40,000 common shares for $16 per share at any time after 1 January 20X18. The common shares were recently valued to be $20 for 20X6.

• 420,000 common shares were outstanding on 31 December 20X6; 40,000 of those shares had been issued for cash on 1 February 20X6.

• Preferred shares are cumulative and have a dividend of $4 per share; 10,000 shares are outstanding. Each share can be converted into four common shares at any time.

• Davidson Ltd. declared and paid dividends totalling $25,000 in 20X6.

Required:

Calculate the following ratios for 20X6 based on the financial statements above:

a. Debt to equity (total debt)

b. Inventory turnover

c. Quick ratio

d. Return on assets (after tax)

e. Return on common shareholder’s equity

f. Accounts receivable turnover (all sales are on account)

g. Asset turnover

h. Return on long-term capital, after tax

i. Operating margin

Step by Step Answer:

Intermediate Accounting Volume 2

ISBN: 9781260881240

8th Edition

Authors: Thomas H. Beechy, Joan E. Conrod, Elizabeth Farrell, Ingrid McLeod-Dick, Kayla Tomulka, Romi-Lee Sevel