At the end of 20X8, Anderson Corp., a public company, had the following balances: In 20X8, the

Question:

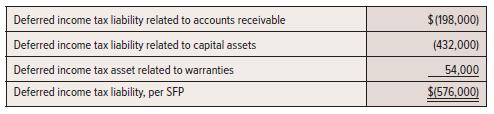

At the end of 20X8, Anderson Corp., a public company, had the following balances:

In 20X8, the company had reported $1,350,000 of taxable income. It also reported a $550,000 long-term receivable, taxable when collected. At the end of 20X8, capital assets had a net book value of $4,800,000 and a UCC balance of $3,600,000. Estimated warranty liabilities were $150,000.

In 20X9, Anderson reported accounting earnings of $2,250,000. Collections on the long-term receivable amounted to $420,000. There were nondeductible golf club dues of $32,000. Warranty expense was equal to claims paid. Depreciation was $200,000 and CCA was $300,000. The tax rate was 38%.

Required:

1. What was the tax rate in 20X8?

2. Prepare a journal entry to record tax expense in 20X9. Tax rates were enacted in the year to which they pertain.

3. Calculate the deferred income tax liability on the SFP at the end of 20X9.

Step by Step Answer:

Intermediate Accounting Volume 2

ISBN: 9781260881240

8th Edition

Authors: Thomas H. Beechy, Joan E. Conrod, Elizabeth Farrell, Ingrid McLeod-Dick, Kayla Tomulka, Romi-Lee Sevel