Crandall Corp. was formed in 20X1. The company uses the comprehensive tax allocation method. Relevant information pertaining

Question:

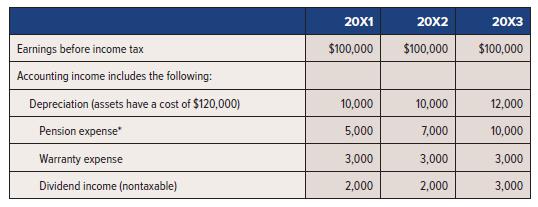

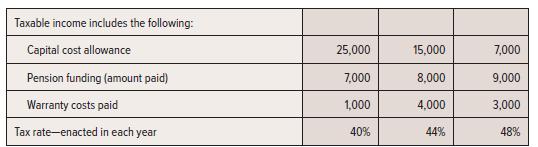

Crandall Corp. was formed in 20X1. The company uses the comprehensive tax allocation method. Relevant information pertaining to 20X1, 20X2, and 20X3 is as follows:

*Pension amounts are tax deductible when paid, not when expensed. Over the long term, payments will equal total expense. The tax basis for the pension will always be zero. For accounting purposes, there will be a statement of financial position asset account asset called “deferred pension cost” for the difference between the amount paid and the expense, since the amount paid is higher.

Required:

Prepare the journal entry to record income tax expense for each year.

Step by Step Answer:

Intermediate Accounting Volume 2

ISBN: 9781260881240

8th Edition

Authors: Thomas H. Beechy, Joan E. Conrod, Elizabeth Farrell, Ingrid McLeod-Dick, Kayla Tomulka, Romi-Lee Sevel