Question: Compass Direction Ltd. has constructed a warehouse facility, paying $560,000 for land on 1 February 20X2, $500,000 to a contractor in late March 20X2, another

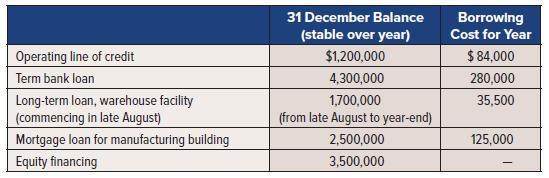

Compass Direction Ltd. has constructed a warehouse facility, paying $560,000 for land on 1 February 20X2, $500,000 to a contractor in late March 20X2, another $2,000,000 in late August 20X2, and finally $1,200,000 in late November 20X2. The warehouse was put into use in early December 20X2. The company had one construction loan, a note payable for $1,700,000. This money was borrowed in late August 20X2. The rest of the acquisition was financed through general borrowing. The company’s capital structure and borrowing costs for the year:

Required:

1. Calculate the cost of general borrowing, and indicate when the capitalization period ends for borrowing costs.

2. Calculate the borrowing cost that is to be capitalized as part of the warehouse asset.

Operating line of credit Term bank loan Long-term loan, warehouse facility (commencing in late August) Mortgage loan for manufacturing building Equity financing 31 December Balance (stable over year) $1,200,000 4,300,000 1,700,000 (from late August to year-end) 2,500,000 3,500,000 Borrowing Cost for Year $ 84,000 280,000 35,500 125,000

Step by Step Solution

3.45 Rating (158 Votes )

There are 3 Steps involved in it

Requirement 1 Cost of borrowing general borrowing 84000 280000 1200000 4300... View full answer

Get step-by-step solutions from verified subject matter experts