Hendrie reported opening balances as at 1 June 20X8: The company had the following transactions in June

Question:

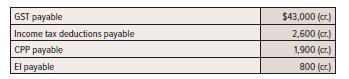

Hendrie reported opening balances as at 1 June 20X8:

The company had the following transactions in June 20X8:

a. Collected $708,000 of GST on sales to customers.

b. Recorded the bimonthly payroll, which included CPP deductions of $2,800, EI deductions of $2,400, and income tax withheld of $21,400.

c. Recorded the second bimonthly payroll. The payroll included CPP deductions of $3,000, EI deductions of $2,800, and income tax withheld of $23,400.

d. Bought capital assets of $1,920,000, plus GST of 5%.

e. Recorded the employer portion of payroll expenses for the entire month.

f. Paid $533,000 GST to the Receiver General for Canada.

Required:

Calculate the balances in the four accounts listed above as at 30 June 20X8. There were no payments on account during the month.

Step by Step Answer:

Intermediate Accounting Volume 2

ISBN: 9781260881240

8th Edition

Authors: Thomas H. Beechy, Joan E. Conrod, Elizabeth Farrell, Ingrid McLeod-Dick, Kayla Tomulka, Romi-Lee Sevel