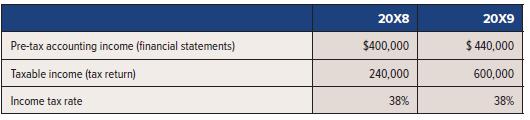

Nalad Corp. provided the following data related to accounting and taxable income: There are no existing temporary

Question:

Nalad Corp. provided the following data related to accounting and taxable income:

There are no existing temporary differences other than those reflected in these data. There are no permanent differences.

Required:

1. How much tax expense would be reported in each year if the taxes payable method was used? What is potentially misleading with this presentation of tax expense?

2. How much tax expense and deferred income tax would be reported using comprehensive tax allocation (liability method)? Why is the two-year total tax expense the same in requirements 1 and 2?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Intermediate Accounting Volume 2

ISBN: 9781260881240

8th Edition

Authors: Thomas H. Beechy, Joan E. Conrod, Elizabeth Farrell, Ingrid McLeod-Dick, Kayla Tomulka, Romi-Lee Sevel

Question Posted: