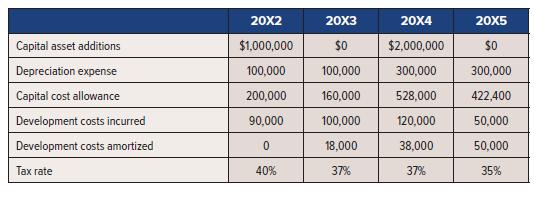

The following information has been provided for Relink Corporation for 20X2-20X5: Required: 1. What is the tax

Question:

The following information has been provided for Relink Corporation for 20X2-20X5:

Required:

1. What is the tax basis of the capital assets in each year?

2. What is the tax basis of the development costs in each year?

3. What is the accounting basis of the capital assets in each year?

4. What is the accounting basis of the development costs in each year?

5. What is the deferred tax balance in each year?

6. Is the deferred tax balance in each year an asset or a liability?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Intermediate Accounting Volume 2

ISBN: 9781260881240

8th Edition

Authors: Thomas H. Beechy, Joan E. Conrod, Elizabeth Farrell, Ingrid McLeod-Dick, Kayla Tomulka, Romi-Lee Sevel

Question Posted: