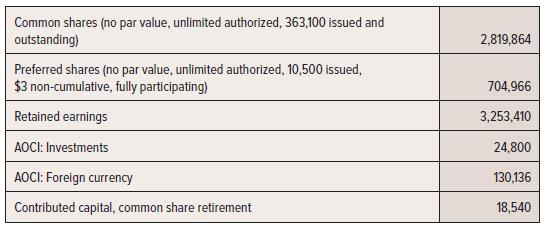

On 1 January 20X0, Reez reported the following in shareholders equity: The following transactions occurred during the

Question:

On 1 January 20X0, Reez reported the following in shareholders’ equity:

The following transactions occurred during the year and have not yet been accounted for (in the order presented):

1. Recorded earnings were $309,450.

2. FVOCI investments with a fair value of $239,000 at the beginning of the year and $222,000 at the end of the year.

3. FVOCI investments with a fair value of $125,000 were sold for $183,500. The original cost of these investments had been $88,000. Accumulated gains are transferred to retained earnings.

4. An exchange loss of $23,900 was incurred on the translation of the financial statements of a foreign subsidiary; this exchange loss is not included in earnings.

5. Revaluation gains of $39,400 were incurred on PP&E that follow the revaluation model.

6. Dividends of $175,000 were declared and paid during the year. The matching dividend is $0.15 per share. Participation is based on the relative share capital account at the beginning of the period.

7. A stock dividend was recorded during the year, involving 26,000 shares to be issued, valued at $7.25 per share. Of these shares, 21,000 were issued in the form of full shares and 5,000 fractional shares for which cash was issued.

Required:

1. Calculate 20X0 comprehensive income.

2. Calculate the balances in all equity accounts, reflecting 20X0 comprehensive income and

the transactions that occurred during the year.

3. Determine the amount paid to preferred and common shareholders.

4. Explain the meaning of each AOCI account. What would make each account increase or decrease?

Step by Step Answer:

Intermediate Accounting Volume 2

ISBN: 9781260881240

8th Edition

Authors: Thomas H. Beechy, Joan E. Conrod, Elizabeth Farrell, Ingrid McLeod-Dick, Kayla Tomulka, Romi-Lee Sevel