During 20X7, Greens Ltd. reported the following: a. FVOCI investments with a recorded fair value of $455,000

Question:

During 20X7, Greens Ltd. reported the following:

a. FVOCI investments with a recorded fair value of $455,000 were sold for $500,500. The original cost of these investments had been $200,000 in 20X5. Accumulated gains are transferred to retained earnings but are not a component of income or comprehensive income.

b. An exchange gain of $150,000 was recorded on the translation of the financial statements of a foreign subsidiary; this exchange gain is not included in earnings but is an element of comprehensive income and AOCI.

c. Recorded earnings were $725,000.

d. Treasury stock, on the books for $350,000, was reissued for $330,000.

e. A second FVOCI investment, held at year-end, had a fair value of $500,000 at the beginning of the year and $480,000 at the end of the year.

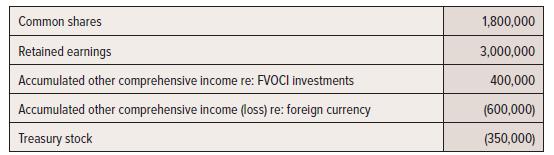

f. A stock dividend was recorded during the year, involving 146,000 shares to be issued, valued at $3.75 per share. Of these shares, 140,000 were issued in the form of full shares and 6,000 fractional shares for which cash was issued. On 1 January 20X7, Greens reported the following in shareholders’ equity:

Required:

1. Calculate 20X7 comprehensive income.

2. Calculate the balances in all equity accounts, reflecting 20X7 comprehensive income and the transactions that occurred during the year.

3. Explain the meaning of each AOCI account. What would make each account increase or decrease?

Step by Step Answer:

Intermediate Accounting Volume 2

ISBN: 9781260881240

8th Edition

Authors: Thomas H. Beechy, Joan E. Conrod, Elizabeth Farrell, Ingrid McLeod-Dick, Kayla Tomulka, Romi-Lee Sevel