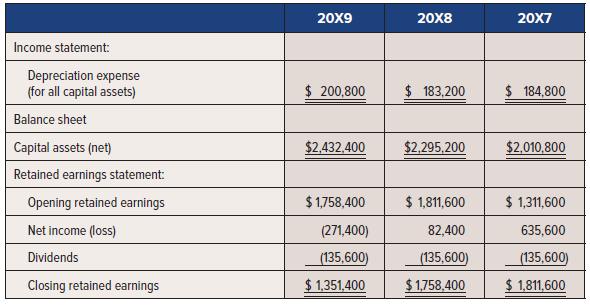

Purple Ltd. reported the following in its 31 December financial statements: After the draft 20X9 financial statements

Question:

Purple Ltd. reported the following in its 31 December financial statements:

After the draft 20X9 financial statements were prepared but before they were issued, Purple discovered that a capital asset was incorrectly accounted for in 20X5. A $400,000 capital asset was purchased early in 20X5, and it should have been depreciated on a straight-line basis over eight years with a $80,000 residual value. Instead, it was written off to expense.

The error was made on the books, but the capital asset was accounted for correctly for tax purposes. The tax rate was 25%.

Required:

1. What entry is needed to correct the error in 20X9? The 20X9 books are still open.

2. Restate all the above information, as appropriate, to retrospectively correct the error.

3. Describe the required disclosure of the error.

Step by Step Answer:

Intermediate Accounting Volume 2

ISBN: 9781260881240

8th Edition

Authors: Thomas H. Beechy, Joan E. Conrod, Elizabeth Farrell, Ingrid McLeod-Dick, Kayla Tomulka, Romi-Lee Sevel