Question: Select SFP data for Emin Corp. for the 31 December 20X5 year-end is as follows: Additional information: a. On 1 April 20X5, 100,000 common shares

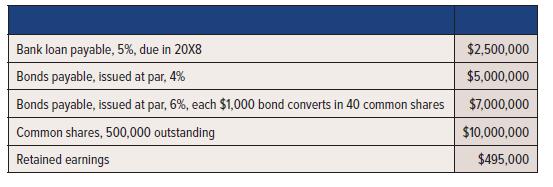

Select SFP data for Emin Corp. for the 31 December 20X5 year-end is as follows:

Additional information:

a. On 1 April 20X5, 100,000 common shares were issued.

b. Common share options are outstanding which entitle holders to acquire 200,000 common shares at $10 per share. The average common share price during 20X5 was $15.

c. A 3-for-1 stock split occurred on March 31, 20X6. The 20X5 financial statements were issued on February 27, 20X5.

d. Emin Corp.’s tax rate is 30%.

e. Emin Corp.’s earnings from continuing operations after tax was $485,000 for 20X5.

f. Emin Corp. had a loss on discontinued operations of $350,000, net of tax in 20X5.

g. In late 20X4 Emin Corp. signed an agreement whereby it agreed to issue two shares to every outstanding shareholder if sales exceeded $1M in 20X5. The sales target was not met in 20X5.

Required:

1. Calculate all EPS figures that Emin Corp. is required to report for 20X5.

2. Does Emin Corp. have any discretion regarding the reporting from requirement 1?

Bank loan payable, 5%, due in 20X8 Bonds payable, issued at par, 4% Bonds payable, issued at par, 6%, each $1,000 bond converts in 40 common shares Common shares, 500,000 outstanding Retained earnings $2,500,000 $5,000,000 $7,000,000 $10,000,000 $495,000

Step by Step Solution

3.38 Rating (145 Votes )

There are 3 Steps involved in it

Requirement 1 Stock split occurred after yearend and after financial statements are issued therefore ... View full answer

Get step-by-step solutions from verified subject matter experts