Question: For each of the following differences between the amount of taxable income and income recorded for financial reporting purposes, compute the effect of each difference

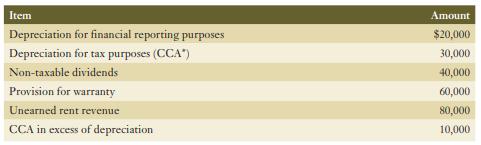

For each of the following differences between the amount of taxable income and income recorded for financial reporting purposes, compute the effect of each difference on deferred taxes balances on the balance sheet. Treat each item independently of the others. Assume a tax rate of 25%.

CCA = capital cost allowance

Item Depreciation for financial reporting purposes Depreciation for tax purposes (CCA*) Non-taxable dividends Provision for warranty Unearned rent revenue CCA in excess of depreciation Amount $20,000 30,000 40,000 60,000 80,000 10,000

Step by Step Solution

3.30 Rating (168 Votes )

There are 3 Steps involved in it

Depreciation for financial reporting purposes This difference will not have any effect on deferred t... View full answer

Get step-by-step solutions from verified subject matter experts