Software Inc. (SI) is a private corporation formed in the 1990s. SI develops and sells software for

Question:

Software Inc. (SI) is a private corporation formed in the 1990s. SI develops and sells software for many purposes; theft recovery, geomapping, data and device security, and IT asset management.

To help motivate management, SI has a stock option plan.

To help fund continued software development, SI has a bank loan with a major bank. The bank requires annual audited financial statements and has a financial covenant that stipulates a minimum current ratio.

SI has an expected taxable loss of $10,000,000 in 20X9. For the last three years the company has had taxable profits of $2,000,000 in 20X6; $5,000,000 in 20X7, and $1,000,000 in 20X8. SI’s taxable loss this year was due to intensive development of new software for security over personal data. SI anticipates sales of this product to be significant due to concerns over identity theft.

You have recently been hired to develop new accounting policies for SI’s 31 December yearend. You have been asked by the owners to discuss alternatives and provide recommendations on the appropriate accounting policies for events below that have occurred during 20X9. Where possible, you have been asked to quantify the impact of the accounting policies. SI is seriously considering going public next year and would like to know how your recommendations would be different if it was a public company. The incremental borrowing rate for SI is 10%. The tax rates for the last few years were 20X6 (38%), 20X7 (39%), and both 20X8 and 20X9 (40%).

1. SI offers computer theft recovery and secure asset-tracking services. These services are provided for a period of one to five years. The customer pays a fee that includes software, monitoring, a warranty, and maintenance. The fee is due 30 days after installation of the software. Sales staff are paid a commission based on the number of service contracts they sell.

2. SI offers a warranty with its theft recovery software. If a computer equipped with the software is stolen and SI is unable to recover the stolen software using its software or delete data on the stolen computer, then the customer is eligible for a warranty of up to $1,000. To qualify, customers must file a police report. The amount of the warranty depends on the value of the stolen computer. Estimated warranty liabilities on the balance sheet at the end of 20X8 were $8 million. During 20X9, the estimated warranty costs based on a percentage of sales will be an additional $5 million. Actual warranty costs during 20X9 were $1 million.

3. SI currently uses the taxes payable method of accounting for income taxes. In 20X8, SI changed its method of accounting for software development from expensing it to capitalizing it as an intangible asset.

4. SI entered into a forward contract for the purchase of new equipment that the company is purchasing from Germany in 20X9 to protect itself against changes in the value of the euro. SI often enters into forward contracts, interest rate swaps, and foreign currency swaps to protect the company from risks. SI also has shares in a number of companies for the sole purpose of earning money. It has an investment department that manages this portfolio of investments. These investments are traded on a frequent basis.

5. SI has installed a series of satellite towers as part of its software-tracking services at a cost of $15 million. There is a regulatory obligation to dismantle these satellite towers in 20 years. The anticipated cost at that time is $2.5 million.

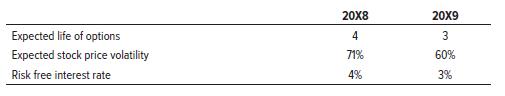

6. SI uses the Black-Scholes method for estimating its stock option expense. During 20X9, SI estimated an expense of $15 million using the following assumptions:

Required:

Prepare the requested report for the owners of SI.

Step by Step Answer:

Intermediate Accounting Volume 2

ISBN: 9781260881240

8th Edition

Authors: Thomas H. Beechy, Joan E. Conrod, Elizabeth Farrell, Ingrid McLeod-Dick, Kayla Tomulka, Romi-Lee Sevel