Summit Holdings Corporation (SHC) is a diversified Canadian company based in Winnipeg. SHCs primary business is the

Question:

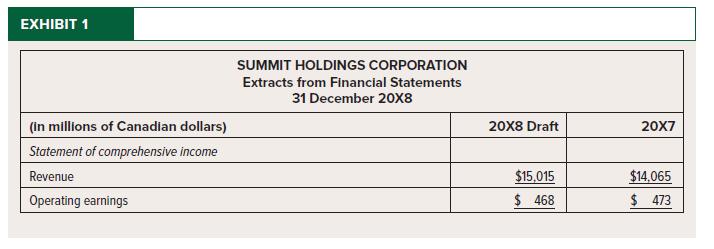

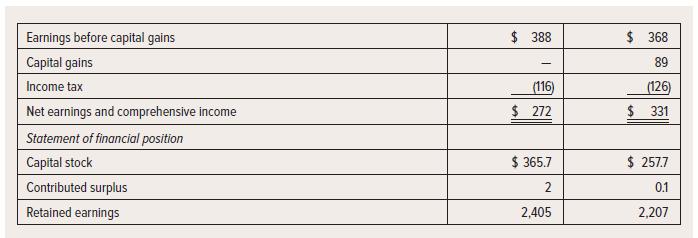

Summit Holdings Corporation (SHC) is a diversified Canadian company based in Winnipeg. SHC’s primary business is the distribution and retailing of pharmaceutical and health care products. Its shares are traded on the Toronto Stock Exchange. Common shares traded in the $8–$14 range in 20X8. The primary holder of SHC’s debt is the Amalgamated Public Sector Pension Plan. Extracts from SHC’s draft 31 December 20X8 year-end financial statements are shown in Exhibit 1; SHC’s share capital disclosures are shown in Exhibit 2.

Company information:

SHC owns and operates distribution facilities in several locations across Canada. The company also operates a chain of retail health care stores. While the company operates stores in every province, SHC has the strongest presence in the western provinces. The company owns the real estate under all of its distribution centres and most of its stand-alone stores but also operates some stores in leased properties. When its stores are “anchor tenants” in small malls, SHC prefers to own the commercial real estate property and act as a landlord to other tenants. Stores in large urban malls, however, are leased from the mall operator.

As an owner of 284 real estate parcels, SHC often engages in real estate transactions, frequently as seller when the company decides to close a store in an underperforming location. Each transaction results in a gain or loss, of course. SHC labels gains on sale of real estate as “capital gains” on the statement of comprehensive income. The term is not used in its income tax context; it is just SHC’s term for gains and losses on sale.

The 20X8 year-end financial statements are in the process of being finalized. The audit committee will be meeting next week, and there are several accounting policy issues remaining to resolve. EPS calculations have yet to be completed. You are a CPA in the corporate reporting department of SHC and will be taking charge of preparing for the audit committee meeting.

Current-year important events and transactions:

Customer accounts

SHC typically reflects a decent accounts receivable turnover ratio in comparison to industry benchmarks. On 15 December 20X8 SHC reviewed its aging receivables listing and noted several aged accounts. SHC became concerned because the receivables are used as collateral as part of its operating loan with the Bank of Surloin. In order not to have to hassle with the aged accounts, SHC transferred all the accounts to R-Inc., who promised to collect on SHC’s behalf. However, SHC has not removed the receivables from its books. If R-Inc. cannot collect, the receivables will revert to SHC. R-Inc. does not reserve the right to further transfer or sell the receivables to another party.

Fire damage

In the late fall of 20X8, one major real estate property owned by SHC burned to the ground in a horrific fire. SHC was the sole occupant of this building, which had a book value of $17 million. Inventory with a book value of $7.2 million was destroyed in the fire. A team of insurance adjustors is assessing the situation; the fire is thought to be electrical in origin. The fire investigators and the insurance adjustors have yet to file their reports.

SHC carries property and casualty insurance. Lawyers for SHC believe that SHC is entitled to insurance recovery for the fair value of the property destroyed. Consequently, SHC filed a claim for $32.2 million, of which $25 million is for the building, and $7.2 million for inventory. The expected payout is $31.2 million, after a $1 million deductible under the policy. Income tax triggered by the potential insurance proceeds is estimated to be $1.4 million in current taxes payable and another $0.7 million in deferred income tax. The property and inventory remain on SHC’s books in the meantime.

Sale of real estate properties

Effective 31 December 20X8, SHC sold certain real estate properties to Sunne Real Estate Investment Trust (Sunne REIT). The properties had a book value of $239 million and were sold for $374 million gross cash proceeds. In addition, SHC received units in Sunne REIT estimated to be worth $50 million. There were brokerage and legal costs of $7 million associated with the sale. Income tax triggered by the sale amounted to $27 million in current taxes payable plus another $4 million in deferred income tax. The transfer has yet to be reflected in the 20X8 financial statements.

As part of the transaction with Sunne REIT, SHC entered into new lease agreements with respect to its occupancy in a portion (25%) of the real estate properties now owned by Sunne REIT. The leases have an expected total term of between 17 and 23 years; initial lease arrangements are established for five years, followed by renewal periods to the end of the term. Minimum rents range from $8 to $14 per square foot, plus a percentage of gross revenue, and there are planned base rental increases every five years.

New referral contract SHC entered into a five-year referral contract during the year. Physiotherapy and chiropractic services represent a large and growing market in Canada, and pharmacists in SHC stores are often consulted by customers about appropriate action. Any retail customer who requests physiotherapy and chiropractic advice or services in a SHC store will be referred to Nature Force Ltd., a national chain that is the Canadian leader in such services. The agreement specifies that in the first year of the agreement, SHC will be paid the higher of $1 million or 30% of client billings resulting from referrals.

Revenues in the second year are 30% of billings, with no minimum, and then the percentage reduces from 30% to 25%, then 20% and 15% over the remaining three years of the contact. After the first year, either side can end the agreement with 60 days’ notice. An appropriate information system has

been established to ascertain the extent of billings Nature Force realizes from the referrals, subject to external verification.

Chapter 20 Earnings per Share 1421

To date, Nature Force has not made any payment to SHC for year 1 minimum payment because the amount is not due until the 12-month anniversary of the agreement, which occurs in October 20X9. No revenue has been recorded by SHC in the 20X8 financial statements. The pharmacists report referrals as “quite strong,” although there are regional differences. Exchange transaction During 20X8 SHC disposed of a vacant parcel of land that it had acquired 10 years ago for $1M. An independent appraiser had provided documentation stating the fair value of the land in 20X8 was $12M. The land is located in a rural community of Winnipeg. Original intent had been to build a distribution facility on the land, but permits were too hard to secure. SHC had eventually abandoned its intentions and the land had been sitting vacant. The disposal of the land occurred via an exchange transaction whereby SHC exchanged the vacant land for another parcel of land in a different province. The land acquired had a book value of $2M and a fair value of $15M. The party with whom SHC exchanged the land plans to use the Winnipeg parcel for farming. Extensive research indicates that there will be no obstacles gaining appropriate permits to build on the site SHC acquired. SHC is aware that surrounding the acquired parcel of land already exist several warehouses and manufacturing plants. SHC recorded the transaction using fair value.

Earnings per share disclosure

The company regularly calculates and disseminates information on basic and diluted EPS numbers, before and after capital gains and income tax. Company management prefers to focus on results before capital gains and income tax when communicating to shareholders, as gains from sale of real estate are sporadic, and business units have operating targets on a pre-tax basis. In 20X7, the company recorded basic earnings before capital gains and income tax of $5.60 per share, and diluted EPS before capital gains and income tax of $4.56. After capital gains and income tax, basic EPS was $5.03 and diluted EPS was $4.99.

In early 20X8 SHC had released a statement that it would issue shares to preferred and common shareholders if net earnings increased more than 35% compared to prior year. The board had approved this pledge in order to demonstrate its commitment to increasing profits and to sharing those profits, not only with internal management but with all shareholders.

SHC is considering disclosing cash flow per share for the 20X8 yearend.

Required:

Adopt the role of the CPA in the corporate reporting role at SHC. In preparation for the upcoming audit committee meeting, prepare a report that includes the analysis of the accounting issues inherent in the transactions above. Recalculate net earnings, as appropriate, and prepare EPS calculations for 20X8.

Step by Step Answer:

Intermediate Accounting Volume 2

ISBN: 9781260881240

8th Edition

Authors: Thomas H. Beechy, Joan E. Conrod, Elizabeth Farrell, Ingrid McLeod-Dick, Kayla Tomulka, Romi-Lee Sevel