Question: The following lease liability amortization table was developed for Smith Company and Lease 34T: Required: 1. Provide an independent proof of the $18,540 liability balance

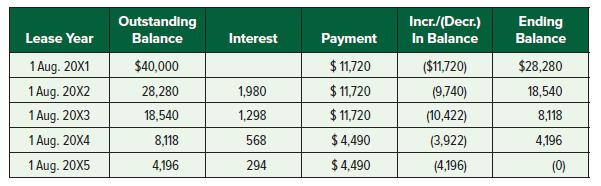

The following lease liability amortization table was developed for Smith Company and Lease 34T:

Required:

1. Provide an independent proof of the $18,540 liability balance after the second payment.

2. Smith has a 31 December fiscal year-end. How much interest expense is recorded in 20X3?

3. What is the balance in the lease liability account at 31 December 20X3? How much of this is a current liability versus a long-term liability?

Lease Year 1 Aug. 20X1 1 Aug. 20X2 1 Aug. 20X3 1 Aug. 20X4 1 Aug. 20X5 Outstanding Balance $40,000 28,280 18,540 8,118 4,196 Interest 1,980 1,298 568 294 Payment $ 11,720 $ 11,720 $ 11,720 $ 4,490 $ 4,490 Incr./(Decr.) In Balance ($11,720) (9,740) (10,422) (3,922) (4,196) Ending Balance $28,280 18,540 8,118 4,196 (0)

Step by Step Solution

3.46 Rating (156 Votes )

There are 3 Steps involved in it

Requirement 1 Requirement 2 Requirement 3 The shortterm port... View full answer

Get step-by-step solutions from verified subject matter experts