The following transactions may change an account in shareholders equity in some way: a. Declare and issue

Question:

The following transactions may change an account in shareholders’ equity in some way:

a. Declare and issue a 2-for-1 stock split.

b. Record donated building.

c. Acquire treasury shares.

d. Record a decrease in the value (an unrealized loss) of FVOCI investments carried at fair market value.

e. Declare dividends on preferred shares.

f. Declare a stock dividend, to be issued in four weeks’ time.

g. Issue the stock dividend in transaction (f), resulting in the issuance of common shares and fractional share rights.

h. Fractional shares issued in (g) are exchanged for common shares (75%) and the rest lapse (25%).

i. Retire common shares for cash at a price higher than the average issuance price to date.

This is the first time common shares have been retired.

j. Reissue treasury shares for cash at a price higher than average acquisition cost. This is the first time treasury shares have been reissued.

k. After the transaction in (j), reissue treasury shares for cash at a price lower than average acquisition cost.

l. Record earnings for the year.

Required:

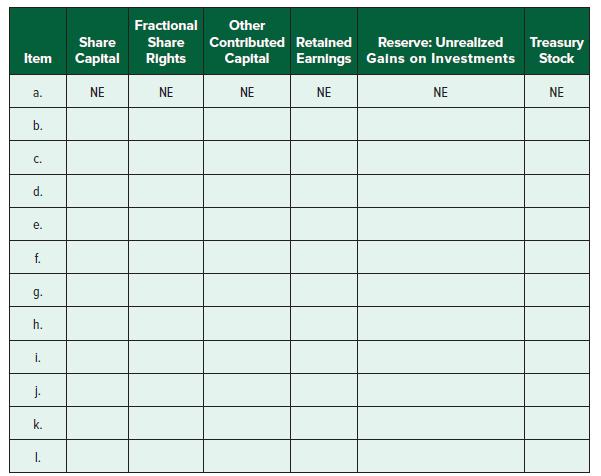

In the table below, indicate the effect of each transaction on the accounts listed. Use I = Increase, D = Decrease, and NE = No effect. The first one is done as an example.

Step by Step Answer:

Intermediate Accounting Volume 2

ISBN: 9781260881240

8th Edition

Authors: Thomas H. Beechy, Joan E. Conrod, Elizabeth Farrell, Ingrid McLeod-Dick, Kayla Tomulka, Romi-Lee Sevel