Howard Corp. is a publicly owned company whose shares are traded on the TSX. At 31 December

Question:

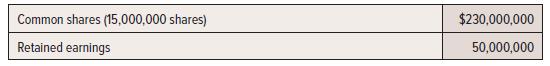

Howard Corp. is a publicly owned company whose shares are traded on the TSX. At 31 December 20X4, Howard had unlimited shares of no-par-value common shares authorized, of which 15,000,000 shares were issued. The shareholders’ equity accounts at 31 December 20X4 had the following balances:

During 20X5, Howard had the following transactions:

a. On 1 February, a distribution of 2,000,000 common shares was completed. The shares were sold for $18 per share.

b. On 15 February, Howard issued, at $110 per share, 100,000 of no par value, $8, cumulative preferred shares.

c. On 1 March, Howard reacquired and retired 20,000 common shares for $14.50 per share.

d. On 15 March, Howard reacquired and retired 10,000 common shares for $20 per share.

e. On 31 March, Howard declared a semi-annual cash dividend on common shares of $0.10 per share, payable on 30 April 20X5, to shareholders of record on 10 April 20X5. (Record the dividend declaration and payment.) The preferred share dividend will be paid on schedule in October.

f. On 15 April, 18,000 common shares were acquired for $17.50 per share and held as treasury stock.

g. On 30 April, 12,500 of the treasury shares were resold for $19.25 per share.

h. On 31 May, when the market price of the common was $23 per share, Howard declared a 5% stock dividend distributable on 1 July 20X5, to common shareholders of record on 1 June 20X5. Treasury shares were not given the stock dividend. The stock dividend was recorded at market value only on distribution. The dividend resulted in fractional share rights issued, that, when exercised, would result in the issuance of 2,300 common shares.

i. On 6 July, Howard issued 300,000 common shares. The selling price was $25 per share.

j. On 30 September, Howard declared a semi-annual cash dividend on common shares of $0.10 per share and the yearly dividend on preferred shares, both payable on 30 October 20X5, to shareholders of record on 10 October 20X5. (Record the dividend declaration and payment.)

k. On 31 December, holders of fractional rights exercised those rights, resulting in the issuance of 1,850 shares. The remaining rights expired.

l. Earnings for 20X5 were $25 million.

Required:

Prepare journal entries to record the listed transactions. Round per-share amounts to two decimal places.

Step by Step Answer:

Intermediate Accounting Volume 2

ISBN: 9781260881240

8th Edition

Authors: Thomas H. Beechy, Joan E. Conrod, Elizabeth Farrell, Ingrid McLeod-Dick, Kayla Tomulka, Romi-Lee Sevel