Question: This problem involves three years of accounting for the defined benefit pension plan of Americo's Inc. The pension plan for the company has been in

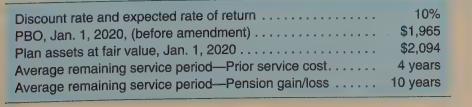

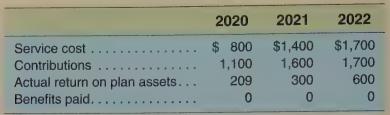

This problem involves three years of accounting for the defined benefit pension plan of Americo's Inc. The pension plan for the company has been in existence for several years before January 1, 2020. The following data relates to the plan.

On January 1,2020 , the company retroactively granted three employees an increase in benefits based on work performed before that date. The immediate present value of those benefits is \(\$ 3,000\).

On January 1, 2020, the actuaries inform the company that on the basis of new estimates, the actuarial gain on the PBO is \(\$ 1,200\). The company elects minimum amortization of the net unrecognized gain or loss using the corridor approach.

On January 1, 2022, the actuaries inform the company that on the basis of new estimates, average life expectancy of retirees and current employees is expected to be higher than previously anticipated. The immediate effect on the actuarial present value of benefits based on the budget formula is a \(\$ 1,400\) loss on the PBO.

Required

For each of the three years 2020 through 2022:

a. Record the pension related journal entries.

b. Prepare the end of year presentation of funded status.

c. Determine the year-end balance in the accumulated other comprehensive income accounts.

Discount rate and expected rate of return PBO, Jan. 1, 2020, (before amendment) Plan assets at fair value, Jan. 1, 2020.... Average remaining service period-Prior service cost. Average remaining service period-Pension gain/loss 10% $1,965 $2,094 4 years 10 years

Step by Step Solution

3.43 Rating (150 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts