Tunito Corp., a public corporation, purchased equipment on 1 March and on the same day arranged for

Question:

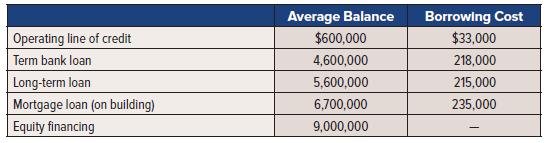

Tunito Corp., a public corporation, purchased equipment on 1 March and on the same day arranged for the supplier to begin customizing the equipment to meet Tunito Corp.’s specific needs. A payment was made to the supplier on 1 March in the amount of $260,000. On 30 April the supplier completed the customization work and shipped out the equipment to Tunito Corp. On 30 April Tunito Corp. paid an additional $40,000. Tunito Corp. received the equipment early in the morning on 30 September. On that same day, Tunito Corp. immediately tested the equipment, and, since it was working perfectly, put the equipment into use on that same date. On 30 September Tunito Corp made the final payment toward the purchase in the amount of $40,000. Tunito Corp. had no specific loan for the acquisition of the equipment but paid for the equipment using general borrowed funds. Tunito Corp.’s capital structure and borrowing costs for the year were as follows:

Tunito Corp. has expensed all borrowing costs for the period.

Required:

1. Calculate the cost of general borrowing. Round to 1 decimal.

2. Calculate the borrowing cost that must be capitalized as part of the equipment. Round to the nearest whole number.

3. Prepare the journal entry to record the capitalized borrowing costs.

4. Explain how depreciation expense would differ if borrowing costs were erroneously not capitalized.

5. Provide a brief statement explaining the difference between how borrowing costs are treated under IFRS and how they are treated under ASPE.

Step by Step Answer:

Intermediate Accounting Volume 2

ISBN: 9781260881240

8th Edition

Authors: Thomas H. Beechy, Joan E. Conrod, Elizabeth Farrell, Ingrid McLeod-Dick, Kayla Tomulka, Romi-Lee Sevel