TXL Corp. has tentatively computed income before tax as $660,000 for 20X4. Retained earnings at the beginning

Question:

TXL Corp. has tentatively computed income before tax as $660,000 for 20X4. Retained earnings at the beginning of 20X4 had a balance of $3,600,000. Dividends of $270,000 were paid during 20X4. There were dividends payable of $60,000 at the end of 20X3 and $90,000 at the end of 20X4. The following information has been provided:

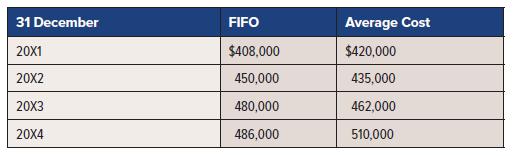

1. The company used FIFO for costing inventory in deriving net income of $660,000. It wishes to change to average cost to be comparable with other companies in the industry. Accordingly, the change in policy should be applied retrospectively. The comparable figures for ending inventory under the two methods are:

2. In January 20X3, the company acquired some equipment for $3,000,000. At that time, it estimated the equipment would have an estimated useful life of 12 years and a salvage value of $360,000. In 20X3, the company received a government grant of $480,000, which assisted in purchasing the equipment. The grant was credited to income in error. The company has been depreciating the equipment on a straight-line basis and has already provided for depreciation for 20X4 without considering the government grant. Management realizes that the company must account for the government grant by crediting it directly to the equipment account and recording a lower amount of depreciation over time.

The income tax rate for the company is 30%. Assume that all of the stated items affect deferred income tax.

Required:

1. Prepare a schedule to show the calculation of the correct earnings for 20X4 in accordance with generally accepted accounting principles.

2. Prepare, in good form, the retained earnings section of TXL’s statement of changes in equity for the year ended 31 December 20X4. Comparative figures need not be provided.

Step by Step Answer:

Intermediate Accounting Volume 2

ISBN: 9781260881240

8th Edition

Authors: Thomas H. Beechy, Joan E. Conrod, Elizabeth Farrell, Ingrid McLeod-Dick, Kayla Tomulka, Romi-Lee Sevel