On 1 January 20X5, Teal Ltd. decided to change the inventory costing method used from average cost

Question:

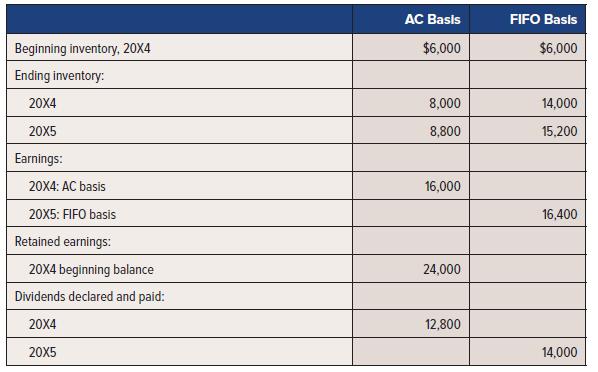

On 1 January 20X5, Teal Ltd. decided to change the inventory costing method used from average cost (AC) to FIFO to conform to industry practice. The annual reporting period ends on 31 December. The average income tax rate is 30%. The following related data were developed:

Required:

1. Identify the type of accounting change involved. Which approach should be used—prospective, retrospective without restatement, or retrospective with restatement? Explain.

2. Give the entry to record the effect of the change, assuming the change was made only for accounting purposes, not for income tax purposes.

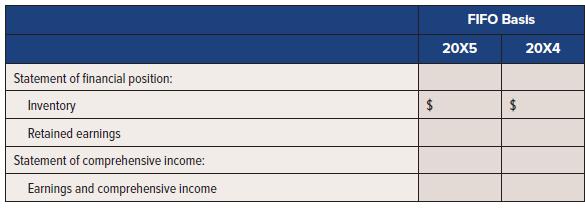

3. Complete the following schedule:

Step by Step Answer:

Intermediate Accounting Volume 2

ISBN: 9781260881240

8th Edition

Authors: Thomas H. Beechy, Joan E. Conrod, Elizabeth Farrell, Ingrid McLeod-Dick, Kayla Tomulka, Romi-Lee Sevel