You are evaluating two public companies in the forest industry. Both companies follow IFRS and are integrated

Question:

You are evaluating two public companies in the forest industry. Both companies follow IFRS and are integrated companies that own or lease timber properties (biological assets), harvest trees, and make building supplies and paper products. This industry is very volatile. The profiles are as follows:Canamora Forest Products Inc.Canamora Forest Products Inc. (CFP) is a leading Canadian-integrated forest products company.The company employs approximately 6,800 people. The company has extensive production facilities in British Columbia and Alberta, and a lumber remanufacturing plant in the United States. The company is a major producer and supplier of lumber and bleached kraft pulp. It also produces semi-bleached and unbleached kraft pulp, bleached and unbleached kraft paper, plywood, remanufactured lumber products, hardboard panelling, and a range of specialized wood products, including baled fibre and fibremat. Products are sold in global markets.

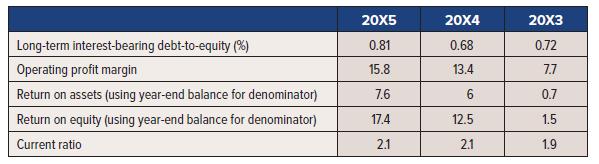

Fallsview Building Materials Ltd.Fallsview is a North American?based producer of building materials, including oriented strand board, medium-density fibreboard, hardwood plywood, lumber, I-joists, specialty papers, and pulp.The company is also the United Kingdom?s largest producer of wood-based panels, including particleboard and value-added products. The company employs over 2,600 people in North America and 1,000 in the United Kingdom.You have obtained some limited industry norms that relate to years prior to those presented for the two companies; industry norms are difficult to establish for the current years. Selected ratios for the forest industry in Canada:

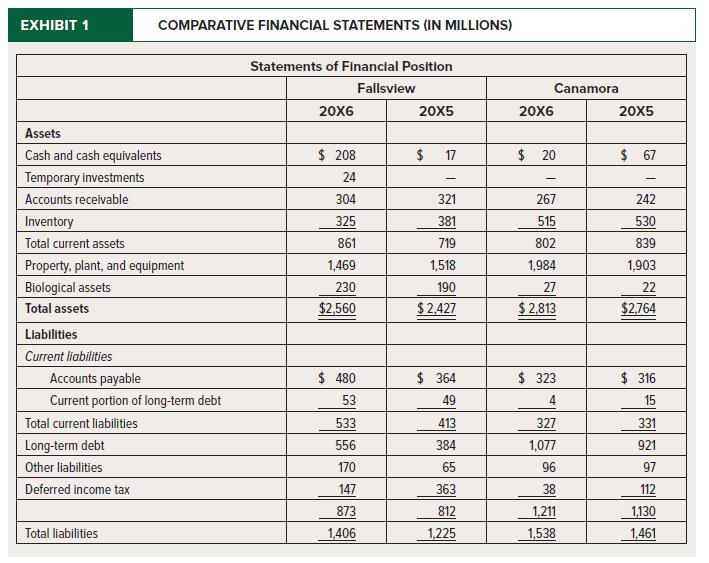

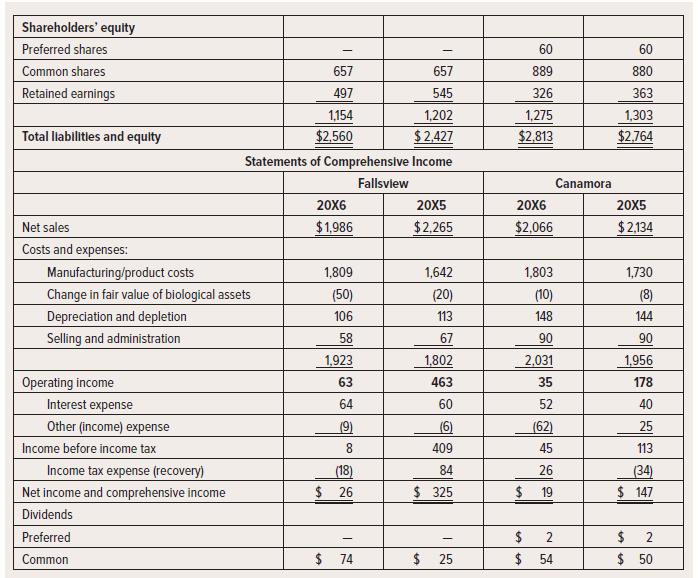

Summarized financial data for each company is shown in Exhibit 1. A standard financial statement analysis form is included.

The companies both have unqualified audit reports and have similar accounting policies except for the following:1. Fallsview uses FIFO while Canamora uses weighted-average cost for inventory.2. Both companies use a combination of straight-line and units-of-production depreciation methods for property, plant, and equipment, but Fallsview uses useful lives that are approximately 25% longer than those used by Canamora.?

Required:Provide an analysis that compares Fallsview and Canamora from the perspective of:1. A potential short-term creditor2. A potential common stock investorAssume a tax rate of 30% for both companies.

Step by Step Answer:

Intermediate Accounting Volume 2

ISBN: 9781260881240

8th Edition

Authors: Thomas H. Beechy, Joan E. Conrod, Elizabeth Farrell, Ingrid McLeod-Dick, Kayla Tomulka, Romi-Lee Sevel