Question: A lessee has the following amortization schedule for a particular lease: The company entered into the lease at the beginning of its fiscal year, on

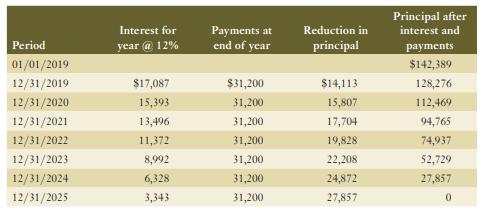

A lessee has the following amortization schedule for a particular lease:

The company entered into the lease at the beginning of its fiscal year, on January 1, 2019. Depreciation follows the straight-line method.

Required:

Provide the appropriate presentation of this lease in the lessee’s statement of financial position for December 31, 2021, distinguishing amounts that are current from those that are non current.

Period 01/01/2019 12/31/2019 12/31/2020 12/31/2021 12/31/2022 12/31/2023 12/31/2024 12/31/2025 Interest for year @ 12% $17,087 15,393 13,496 11,372 8,992 6,328 3,343 Payments at end of year $31,200 31,200 31,200 31,200 31,200 31,200 31,200 Reduction in principal $14,113 15,807 17,704 19,828 22,208 24,872 27,857 Principal after interest and payments $142,389 128,276 112,469 94,765 74,937 52,729 27,857 0

Step by Step Solution

3.53 Rating (163 Votes )

There are 3 Steps involved in it

Lease obligation noncurrent 128276 Lease obligation current 31200 Ac... View full answer

Get step-by-step solutions from verified subject matter experts