Question: The question below is similar to this question (5 Marks) National Finance Company, signed a lease agreement with a leading logistic company of Oman on

The question below is similar to this question

The question below is similar to this question

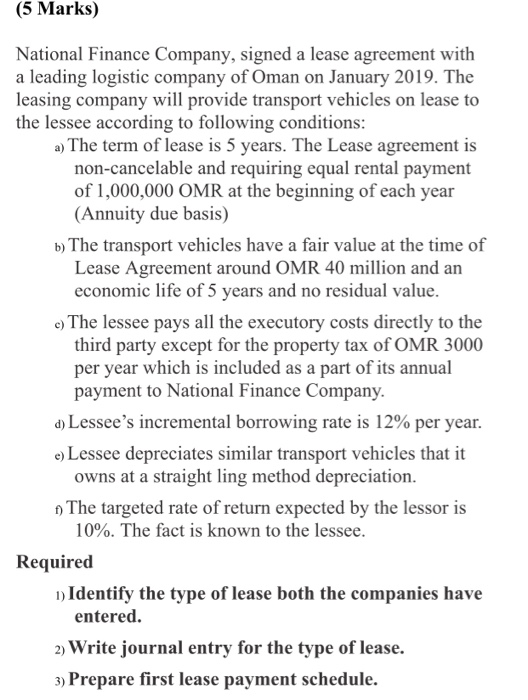

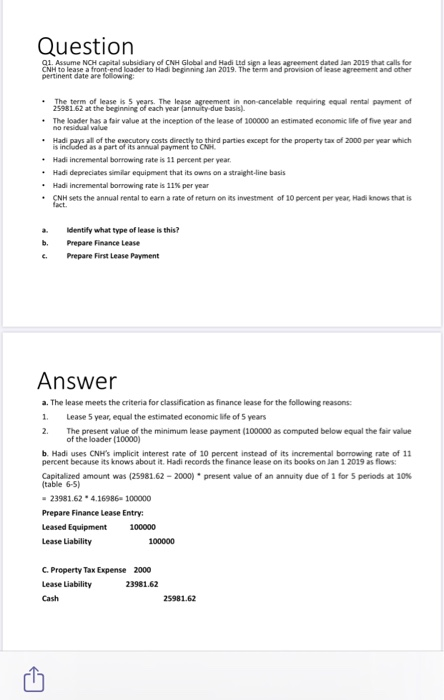

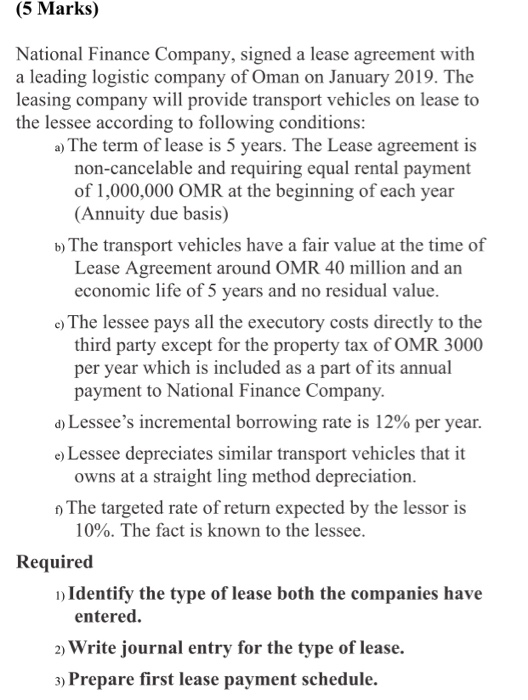

(5 Marks) National Finance Company, signed a lease agreement with a leading logistic company of Oman on January 2019. The leasing company will provide transport vehicles on lease to the lessee according to following conditions: a) The term of lease is 5 years. The Lease agreement is non-cancelable and requiring equal rental payment of 1,000,000 OMR at the beginning of each year (Annuity due basis) b) The transport vehicles have a fair value at the time of Lease Agreement around OMR 40 million and an economic life of 5 years and no residual value. c) The lessee pays all the executory costs directly to the third party except for the property tax of OMR 3000 per year which is included as a part of its annual payment to National Finance Company. d) Lessee's incremental borrowing rate is 12% per year. e) Lessee depreciates similar transport vehicles that it owns at a straight ling method depreciation. 1) The targeted rate of return expected by the lessor is 10%. The fact is known to the lessee. Required 1) Identify the type of lease both the companies have entered. 2) Write journal entry for the type of lease. 3) Prepare first lease payment schedule. TUSK I - HOMHTZAUIOR DI ACQUHUNG SAAPUS (5 marks) Once Sir Bryan Carsberg (1996) former IASC's Secretary General stated that this is a sign of the times. The world is becoming a global marketplace and one can't refuse to recognize that". This statement has its long-term implications because in today's fast globalization of trade and investment, harmonization of financial information at national or regional levels is not enough. The accountancy profession has long recognized the need for a globally harmonized accountancy framework. Samuels and Piper (1985) define the harmonization of accounting as an attempt to bring together different systems. It is the process of blending and combining various practices into an orderly structure, which produces a "synergistic result". While some see harmonization more as a process of moving to a system of uniformity or standardization, most view harmonization as a process whereby the number of allowed accounting alternatives is reduced as a means of promoting greater comparability. Radebaugh and Gray (1997) state pressures for the harmonization of international accounting as a means to achieve comparability, are growing. Several organizations at the international levels have been engaged in this process despite several hurdles involved in this process. Al Mudahki, J. (2003). HARMONIZATION OF ACCOUNTING STANDARDS IN GULF COUNTRIES. Delhi Business Review, 4(1). The Arabian Gulf countries are having many similarities and less dissimilarities of various aspects of business, culture and economy. The countries by forming "Gulf Cooperation Council" gave an evidence to their adaptability to the idea of Harmonizing the accounting policies in the gulf region. Required: (a) Define Harmonization and Convergence and describe IASC's efforts for Harmonization at Global and Regional level. (2+2+6 = 10 marks) (b) Give minimum 3 examples of Harmonization of accounting policies and practices by GCC nations. (5 marks) Question 91. Assume NCH Capital subsidiary of CNH Global and Hadi Lid sign a leas agreement dated Jan 2019 that calls for CN to lease a front end loader to Hadi beginning Jan 2019. The term and provision of lease agreement and other pertinent date are following: The term of lease is 5 years. The lease agreement in non-cancelable requiring equal rental payment of 25981.62 at the beginning of each year annuity due basis The loader has a fair value at the inception of the lease of 100000 an estimated economie life of five year and no residual value .Hadi pays all of the executory costs directly to third parties except for the property tax of 2000 per year which is included as a part of its annual payment to CNH. Hadi incremental borrowing rate is 11 percent per year. .Hadi depreciates similar equipment that its owns on a straight-line basis Hadi incremental borrowing rate is 11% per year NH sets the annual rental to earn a rate of return on its investment of 10 percent per year, Hadi knows that is Identify what type of lease is this? Prepare Finance Lease Prepare First Lease Payment Answer a. The lease meets the criteria for classification as finance lease for the following reasons: 1. Lease 5 year, equal the estimated economic life of 5 years 2. The present value of the minimum lease payment (100000 as computed below equal the fair value of the loader (10000) b. Hadi uses CNH's implicit interest rate of 10 percent instead of its incremental borrowing rate of 11 percent because its knows about it. Hadi records the finance lease on its books on Jan 1 2019 as flows: Capitalized amount was (25981.62 - 2000) - present value of an annuity due of 1 for 5 periods at 10% (table 6-5) - 23981.62 4.16986-100000 Prepare Finance Lease Entry: Leased Equipment 100000 Lease Liability 100000 C. Property Tax Expense 2000 Lease Liability 23981.62 Cash 25981.62 (5 Marks) National Finance Company, signed a lease agreement with a leading logistic company of Oman on January 2019. The leasing company will provide transport vehicles on lease to the lessee according to following conditions: a) The term of lease is 5 years. The Lease agreement is non-cancelable and requiring equal rental payment of 1,000,000 OMR at the beginning of each year (Annuity due basis) b) The transport vehicles have a fair value at the time of Lease Agreement around OMR 40 million and an economic life of 5 years and no residual value. c) The lessee pays all the executory costs directly to the third party except for the property tax of OMR 3000 per year which is included as a part of its annual payment to National Finance Company. d) Lessee's incremental borrowing rate is 12% per year. e) Lessee depreciates similar transport vehicles that it owns at a straight ling method depreciation. 1) The targeted rate of return expected by the lessor is 10%. The fact is known to the lessee. Required 1) Identify the type of lease both the companies have entered. 2) Write journal entry for the type of lease. 3) Prepare first lease payment schedule

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts