Question: Andrew, Inc. provides DJ services for corporate parties. Andrew operates in a jurisdiction that allows carryback for two years and unlimited carryforward. Andrew reported a

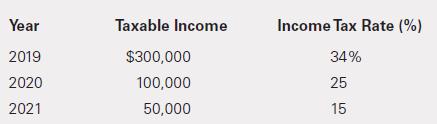

Andrew, Inc. provides DJ services for corporate parties. Andrew operates in a jurisdiction that allows carryback for two years and unlimited carryforward. Andrew reported a net operating loss of $750,000 on its 2022 tax return. During the 3 preceding years, Andrew had taxable income and paid taxes at various tax rates as follows:

Although Andrew had a net operating loss in 2022, it was because of an unusual event. Andrew’s management has substantial evidence to indicate that the company will be profitable over the foreseeable future and will incur a 34% tax rate for each of those years. In fact, during 2023, Andrew reported a profit before tax of $800,000. Andrew does not report any book-tax differences.

Requireda. Prepare the journal entries to account for the NOL carryback and NOL carryforward in 2022.b. Compute reported net income (loss) after tax for 2022.c. Prepare the journal entries to account for income taxes in 2023.d. Compute reported net income after tax for 2023.

Year 2019 2020 2021 Taxable Income $300,000 100,000 50,000 Income Tax Rate (%) 34% 25 15

Step by Step Solution

3.48 Rating (164 Votes )

There are 3 Steps involved in it

a Journal entries to record the NOL carryback and car... View full answer

Get step-by-step solutions from verified subject matter experts