Assume the facts given in P6.9 for Essan Construction Inc. except assume that at December 31, 2021,

Question:

Assume the facts given in P6.9 for Essan Construction Inc. except assume that at December 31, 2021, Essan estimates the costs to complete the road contract at $1,050,000 instead of $600,000.

Instructions

a. Using the percentage-of-completion method, calculate the percent complete for 2020 and 2021. Round the percent complete to four decimal places.

b. Calculate the amount of revenue to be recognized in 2020 and 2021.

c. Calculate the construction costs to be expensed in 2021.

d. Prepare the journal entry at December 31, 2021, to record long-term contract revenues, expenses, and losses for 2021.

e. What is the balance in the Contract Asset/Liability account at December 31, 2020 and 2021?

f. Show how the construction contract would be reported on the SFP and the income statement for the year ended December 31, 2021.

g. Assume that Essan uses the zero-profit or completed-contract method. What would be the journal entry recorded on December 31, 2021?

P6.9

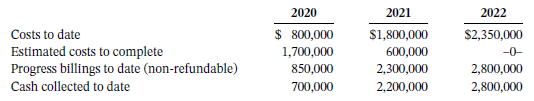

Essan Construction Inc., which has a calendar year end, has entered into a non-cancellable fixed price contract for $2.8 million beginning September 1, 2020, to build a road for a municipality. It has been estimated that the road construction will be complete by June 2022. The following data pertain to the construction period.

Step by Step Answer:

Intermediate Accounting Volume 1

ISBN: 978-1119496496

12th Canadian edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield, Irene M. Wiecek, Bruce J. McConomy