Question: Assume the same facts as in E 431, but that Shields Company reports under IFRS. For each expenditure, indicate the amount that would be reported

Assume the same facts as in E 4–31, but that Shields Company reports under IFRS. For each expenditure, indicate the amount that would be reported in the quarterly income statements for the periods ending March 31, June 30, September 30, and December 31.

Data From E4-31

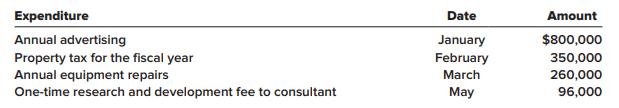

Shields Company is preparing its interim report for the second quarter ending June 30. The following payments were made during the first two quarters:

Require:

For each expenditure, indicate the amount that would be reported in the quarterly income statements for the periods ending March 31, June 30, September 30, and December 31.

Expenditure Date Amount $800,000 Annual advertising Property tax for the fiscal year Annual equipment repairs One-time research and development fee to consultant January February 350,000 March 260,000 May 96,000

Step by Step Solution

3.37 Rating (166 Votes )

There are 3 Steps involved in it

Under IFRS the interim financial statements should reflect the proportionate s... View full answer

Get step-by-step solutions from verified subject matter experts