Question: Presented below are condensed financial statements adapted from those of two actual companies competing in the pharmaceutical industryJohnson and Johnson (J&J) and Pfizer, Inc. ($

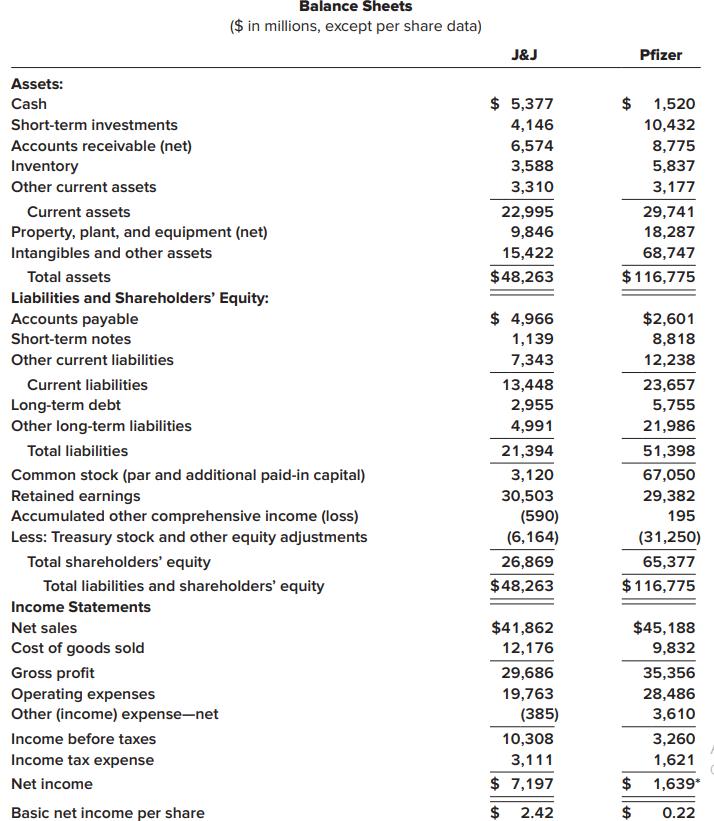

Presented below are condensed financial statements adapted from those of two actual companies competing in the pharmaceutical industry—Johnson and Johnson (J&J) and Pfizer, Inc. ($ in millions, except per share amounts).

Required:

Evaluate and compare the two companies by responding to the following questions. Because two-year comparative statements are not provided, you should use year-end balances in place of average balances as appropriate.

1. Which of the two companies appears more efficient in collecting its accounts receivable and managing its inventory?

2. Which of the two firms had greater earnings relative to resources available?

3. Have the two companies achieved their respective rates of return on assets with similar combinations of profit margin and turnover?

4. From the perspective of a common shareholder, which of the two firms provided a greater rate of return?

5. From the perspective of a common shareholder, which of the two firms appears to be using leverage more effectively to provide a return to shareholders above the rate of return on assets?

Balance Sheets ($ in millions, except per share data) J&J Pfizer Assets: Cash $ 5,377 2$ 1,520 Short-term investments 4,146 10,432 Accounts receivable (net) Inventory 6,574 8,775 3,588 5,837 Other current assets 3,310 3,177 Current assets 22,995 29,741 Property, plant, and equipment (net) 9,846 18,287 Intangibles and other assets 15,422 68,747 Total assets $48,263 $116,775 Liabilities and Shareholders' Equity: Accounts payable $ 4,966 $2,601 Short-term notes 1,139 8,818 Other current liabilities 7,343 12,238 Current liabilities 13,448 23,657 Long-term debt Other long-term liabilities 2,955 5,755 4,991 21,986 Total liabilities 21,394 51,398 3,120 Common stock (par and additional paid-in capital) Retained earnings Accumulated other comprehensive income (loss) Less: Treasury stock and other equity adjustments 67,050 30,503 29,382 (590) (6,164) 195 (31,250) Total shareholders' equity 26,869 65,377 Total liabilities and shareholders' equity $48,263 $116,775 Income Statements Net sales $41,862 $45,188 Cost of goods sold 12,176 9,832 Gross profit Operating expenses Other (income) expense-net 29,686 35,356 19,763 28,486 (385) 3,610 Income before taxes 10,308 3,260 Income tax expense 3,111 1,621 Net income $ 7,197 $ 1,639* Basic net income per share 2$ 2.42 $ 0.22

Step by Step Solution

3.43 Rating (162 Votes )

There are 3 Steps involved in it

1 With high turnover percentages the JJ Company manages current assets more effectively than the Pfizer Company 2 In terms of resources JJ Company is ... View full answer

Get step-by-step solutions from verified subject matter experts