Question: Beck-Curry Associates reported the following income information for the 20192021 period: The company does not have any book-tax differences and is subject to a 21%

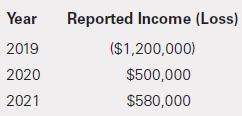

Beck-Curry Associates reported the following income information for the 2019–2021 period:

The company does not have any book-tax differences and is subject to a 21% income tax rate. Beck-Curry is filing a US Corporate Income Tax Return.

Required

a. Prepare the journal entry to record the 2019 income tax provision.

b. Prepare the journal entry to record the 2020 income tax provision.

c. Prepare the journal entry to record the 2021 income tax provision.

d. Determine the balance of the deferred tax asset at the end of 2021.

e. Assume that a newly enacted tax law increases the income tax rate to 25% on January 2, 2022. Prepare the journal entry to record the effects of the tax rate change.

Year 2019 2020 2021 Reported Income (Loss) ($1,200,000) $500,000 $580,000

Step by Step Solution

3.53 Rating (163 Votes )

There are 3 Steps involved in it

a NOL Income Tax Benefit 1200000 x 21 252000 Deferred Tax Ass... View full answer

Get step-by-step solutions from verified subject matter experts