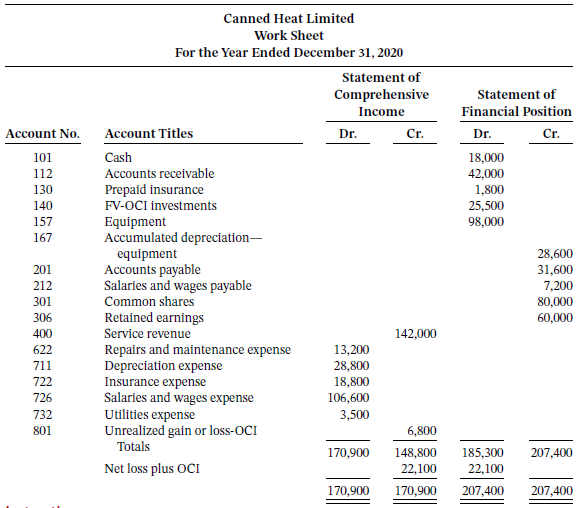

Question: Below are the completed financial statement columns of the work sheet for Canned Heat Limited: Instructions a. Prepare a statement of comprehensive income, statement of

Below are the completed financial statement columns of the work sheet for Canned Heat Limited:

Instructions

a. Prepare a statement of comprehensive income, statement of changes in equity, and statement of financial position. During 2020, Canned Heat?s shareholders invested $24,000 in exchange for common shares. Accumulated other comprehensive income had a balance of $0 on January 1, 2020.

b. Prepare closing entries for the year ended December 31, 2020, and a post-closing trial balance. Income Summary is account number 350 and Accumulated Other Comprehensive Income is account number 310.

c. Briefly discuss how the financial statements in part (a) would change if Canned Heat followed ASPE rather than IFRS.

d. Assume that Canned Heat operates as a partnership. What additional changes, beyond those discussed in part (c), would affect the financial statements prepared in part (a)?

Canned Heat Limited Work Sheet For the Year Ended December 31, 2020 Statement of Comprehensive Statement of Financial Position Income Account Titles Account No. Dr. Cr. Dr. Cr. 101 Cash Accounts receivable 18,000 42,000 1,800 25,500 98,000 112 Prepaid insurance FV-OCI investments Equipment Accumulated depreciation- equipment Accounts payable Salaries and wages payable Common shares 130 140 157 167 28,600 31,600 7,200 80,000 201 212 301 Retained earnings 306 60,000 400 Service revenue 142,000 Repairs and maintenance expense Depreciation expense Insurance expense Salaries and wages expense Utilities expense Unrealized gain or loss-OCI 622 13,200 711 28,800 722 18,800 726 106,600 732 3,500 801 6,800 Totals 170,900 148,800 185,300 22,100 207,400 Net loss plus OCI 22,100 207,400 170,900 170,900 207,400

Step by Step Solution

3.37 Rating (163 Votes )

There are 3 Steps involved in it

a Statement of Comprehensive Income Income Service revenue 142000 Expenses Repairs and maintenance expense 13200 Depreciation expense 28800 Insurance ... View full answer

Get step-by-step solutions from verified subject matter experts