Question: F. A collared floater is like a variable rate bond, but with an upper limit and a lower limit on the rate of coupon payment.

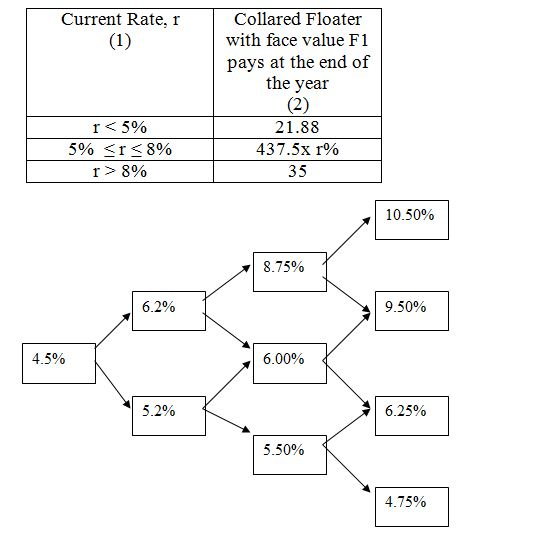

F. A collared floater is like a variable rate bond, but with an upper limit and a lower limit on the rate of coupon payment. Consider, for example, annual rates coupon payment and one-year spot interest rates. In the following table, the current one-year spot interest rate is denoted by r in column (1). Depending on the current spot interest rate, the collared floater with a face value of 437.5dollars will pay the holder of this floater a sum a year later, as given in column (2) of the table. The binomial tree below gives the evolution of one-year spot interest rates over a four year period.

22. What is the current fair value of the four-year collared floater if the risk-neutral probabilities in the binomial tree are 0.5 and 0.5 for the up and down moves, respectively?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts