Changing Assumptions Ltd. has the following details related to its defined benefit pension plan as at December

Question:

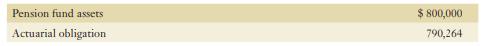

Changing Assumptions Ltd. has the following details related to its defined benefit pension plan as at December 31, 2019:

The actuarial obligation represents the present value of a single benefit payment of $1,400,000 that is due on December 31, 2025, discounted at an interest rate of 10%; that is, $1,400,000 ÷ 1.106 = $790,264.

Funding during 2020 was $65,000. The actual value of pension fund assets at the end of 2020 was $950,000. As a result of the current services received from employees, the single payment due on December 31, 2025, had increased from $1,400,000 to $1,500,000.

Required:

a. Compute the current service cost for 2020 and the amount of the accrued benefit obligation at December 31, 2020. Perform this computation for interest rates of 8%, 10%, and 12%.

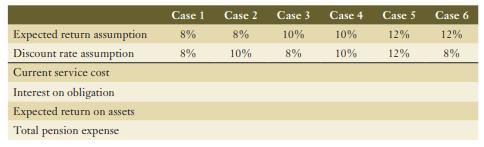

b. Ignore the requirement to use the same rate for return on assets and interest on obligations. Derive the pension expense for 2020 under various assumptions about

(i) The expected return, and

(ii) The discount rate, by completing the following table:

c. Briefly comment on the different amounts of pension expense in relation to the assumptions for expected return and discount rate.

d. Comment on why IAS 19 requires the use of a discount rate that is the same as the rate of return on assets.

e. How does a change in the discount rate affect the accrued benefit obligation?

Step by Step Answer: