Comco Tool Corp. records depreciation annually at the end of the year. Its policy is to take

Question:

Comco Tool Corp. records depreciation annually at the end of the year. Its policy is to take a full year?s depreciation on all assets that are used throughout the year and depreciation for half a year on all machines that are acquired or disposed of during the year. The depreciation rate for the machinery is 10%, applied on a straight-line basis, with no estimated scrap or residual value.

The balance of the Machinery account at the beginning of 2020 was $172,300; the Accumulated Depreciation on Machinery account had a balance of $72,900. The machinery accounts were affected by the following transactions that occurred in 2020:

Jan. 15 Machine no. 38, which cost $9,600 when it was acquired on June 3, 2013, was retired and sold as scrap metal for $600.

Feb. 27 Machine no. 81 was purchased. The fair value of this machine was $12,500. It replaced two machines, nos. 12 and 27, which were traded in on the new machine. Machine no. 12 was acquired on February 4, 2008, at a cost of $5,500 and was still carried in the accounts, although it was fully depreciated and not in use.?

Machine no. 27 was acquired on June 11, 2013, at a cost of $8,200. In addition to these two used machines, Comco paid $9,000 in cash.

Apr. 7 Machine no. 54 was equipped with electric controls at a cost of $940. This machine, originally equipped with simple hand controls, was purchased on December 11, 2016, for $1,800. The new electric controls can be attached to any one of several machines in the shop.

12 Machine no. 24 was repaired at a cost of $720 after a fire caused by a short circuit in the wiring burned out the motor and damaged certain essential parts.

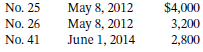

July 22 Machines 25, 26, and 41 were sold for $3,100 cash. The purchase dates and cost of these machines were as follows:

Instructions

a. Record each transaction in general journal form.

b. Calculate and record depreciation for the year. None of the machines currently included in the balance of the account was acquired before January 1, 2012.

c. Digging Deeper As an investor of Comco Tool Corp., would you view regular gains on the disposition of equipment favourably? Explain.

Step by Step Answer:

Intermediate Accounting Volume 1

ISBN: 978-1119496496

12th Canadian edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield, Irene M. Wiecek, Bruce J. McConomy